Charts of the Week: The Fed's Current Predicament

The data behind the Fed's "risk management cut" to rates

Every Friday, I’ll share charts that highlight key insights into the current state of the economy or financial markets. Commentary will be minimal—I aim to let the charts speak for themselves and serve as a starting point for discussion. Facts are facts, but interpretations can vary.

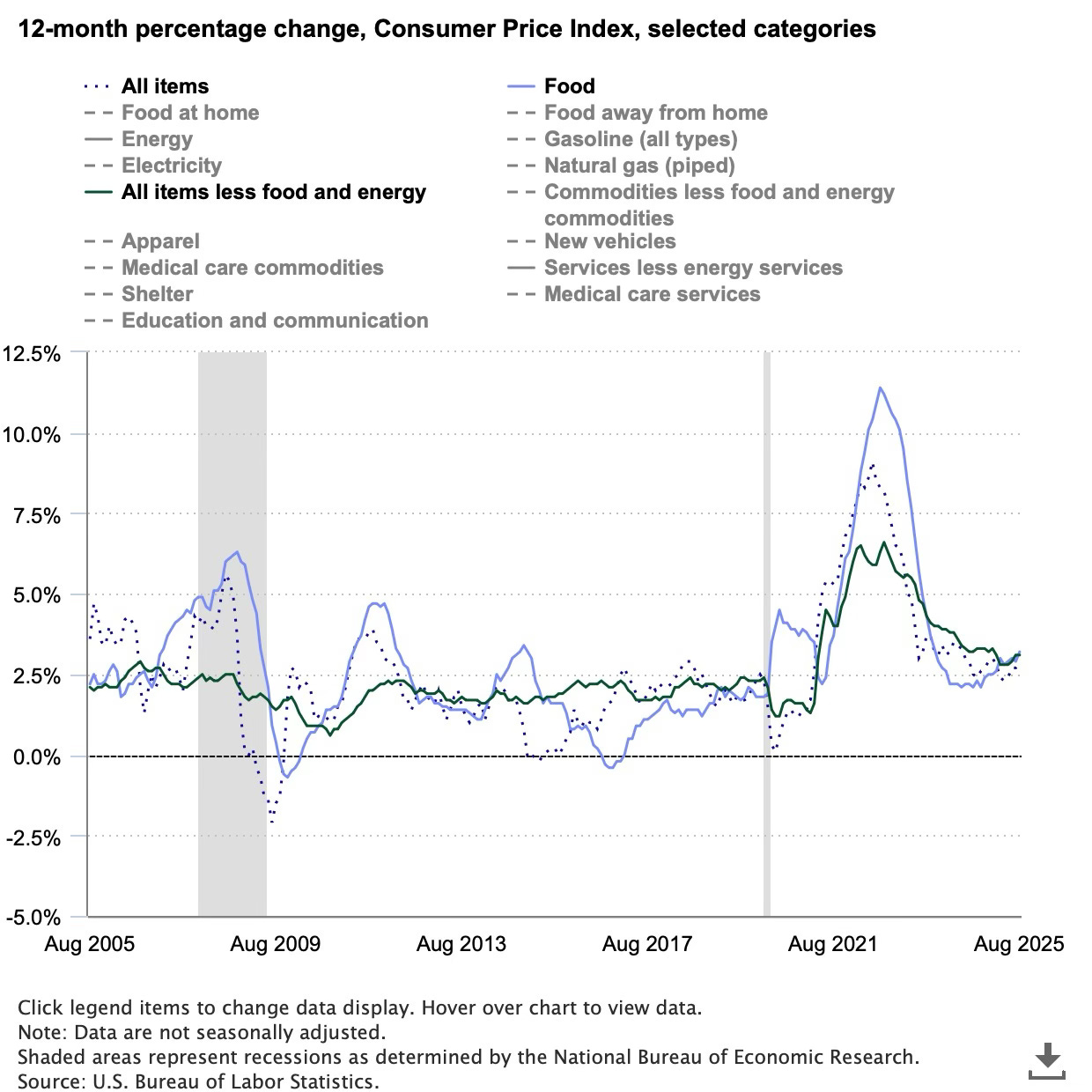

Disinflation has stalled.

The majority of FOMC members think inflation w…