Investment Memo #1: Utah Medical Products, Inc. (NASDAQ: UTMD)

UTMD, headquartered in Utah, is a profitable medical devices company that makes critically important fetal monitoring accessories, vacuum-assisted delivery systems, and other labor and delivery tools.

Investment Summary:

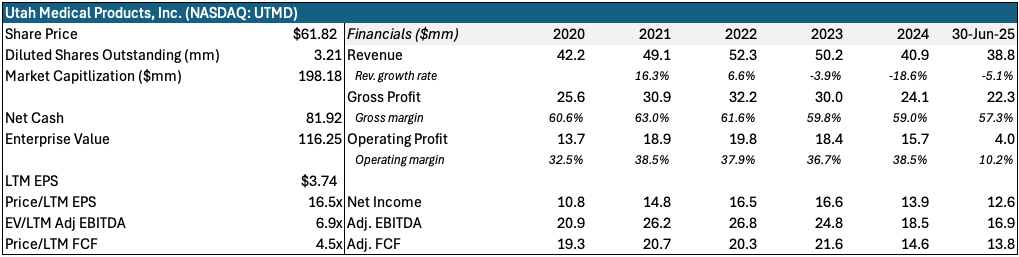

Strong Balance Sheet with $82mm in cash and no debt

Long history of paying dividend

21 consecutive years of regular quarterly cash dividends and dividend growth (2 years negative growth rate, 2022 and 2011)

Current dividend yield of 1.97% ($1.22) per year.

Consistent track record of generating free cash flow for 30 consecutive years

Total …