The Official Launch, The Economy Might Be Better Off Than You Think, and The Risk of Re-Inflation

Welcome to Notes on the Market, the economy just might be doing better than we think, however, there is a risk of inflation reigniting.

Welcome to Notes on the Market

Seeing that this newsletter’s “coming soon” post was published over a year ago, it’s safe to say I’ve wanted to launch this Substack for quite some time. I could blame the delay on a lack of time, but the truth is I wasn’t sure anyone would care to read it. Eventually, I realized that doesn’t matter. I enjoy writing, and I’m always reading about the markets and the economy—so I figure why not put my notes down here and let anyone who’s interested follow along. Welcome again, and please subscribe and share as you please.

1. The economy ain’t so bad

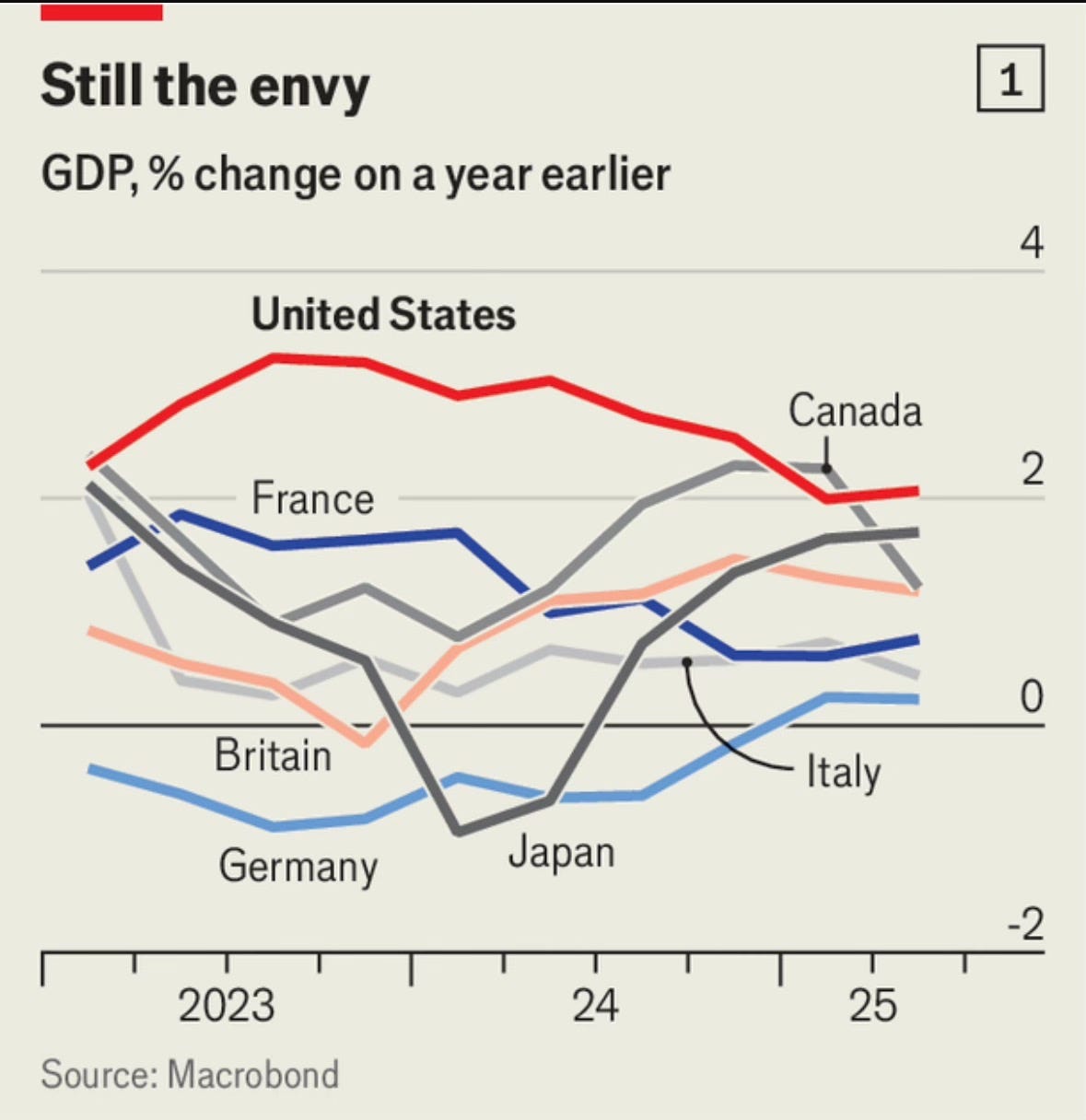

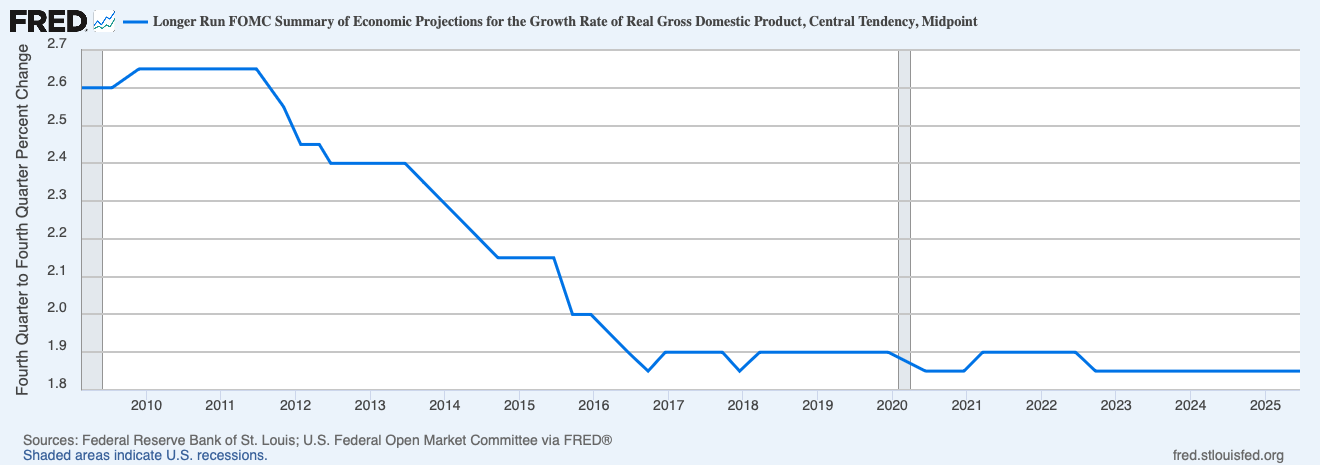

The U.S. GDP growth rate is the highest amongst most developed nations and the highest across G-7 nations. Given the “long-term neutral” or the potential real GDP growth rate for the U.S.—i.e. what the growth of the economy can sustain over the long run, when operating near full capacity and without generating inflation pressures—is estimated by the Fed to be 1.85% (see the following chart) the fact that the U.S. Real GDP growth rate as of 2Q25 is +3.3%, according to the U.S. Bureau of Economic Analysis, the economy seems to be growing well above the long-term sustainable rate. Which leads to my next point….

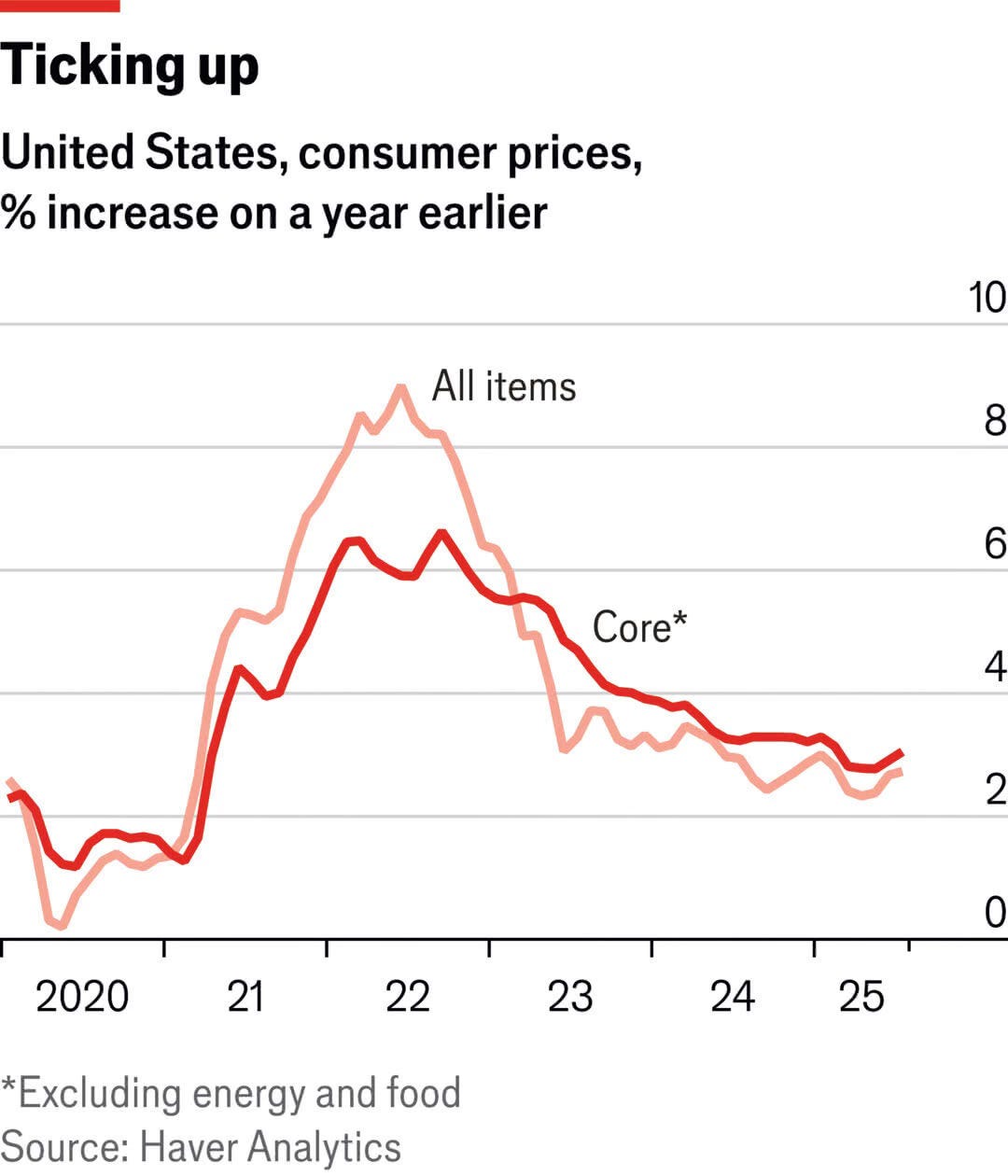

2. There is a risk of inflation re-emerging

When an economy is overheated—growing faster than its potential— this can lead to inflation. Since one of the main drivers behind the U.S. GDP growth is from consumer spending—its the largest component of the equation and accounts for about 65-70% of total U.S. GDP—which remains supportive, we could see a re-ignition of inflation if the job market doesn't fall off and the Fed cuts interest rates.

Next week I will continue with the risks on re-inflation and how tariffs may or may not be a key driver

Great read!!! Need more!

Great insights!