Stagflation Risks in the Economy

Inflation remains uncontrolled and the fed just lowered rates on concerns for the job market, does this mean a real risk of stagflation?

**Correction: my previous post had a crucial mistake in the subtitle. This version has been updated to correctly state that the Fed just lowered rates*

Stagflation is a situation where the inflation rate is elevated, unemployment is rising, and economic growth is slow or non-existent. In a normal economic cycle, growth typically occurs alongside a healthy labor market, which can lead to inflation. However, this isn’t necessarily a concern, as prices tend to increase naturally with higher productivity—people are earning more and spending more. As long as inflation remains moderate (the Fed targets an average rate of 2%), it’s considered manageable.

In a stagflationary environment, however, prices continue to rise while unemployment increases, and growth stagnates. This combination hurts consumer spending, as more people are out of work and have less purchasing power. Companies face higher input costs amid weaker demand from consumers, which hurts profit margins. Investors tend to pull back, affecting both stocks and bonds—slow growth weighs on equities, while higher inflation erodes fixed income returns.

Inflation Risks

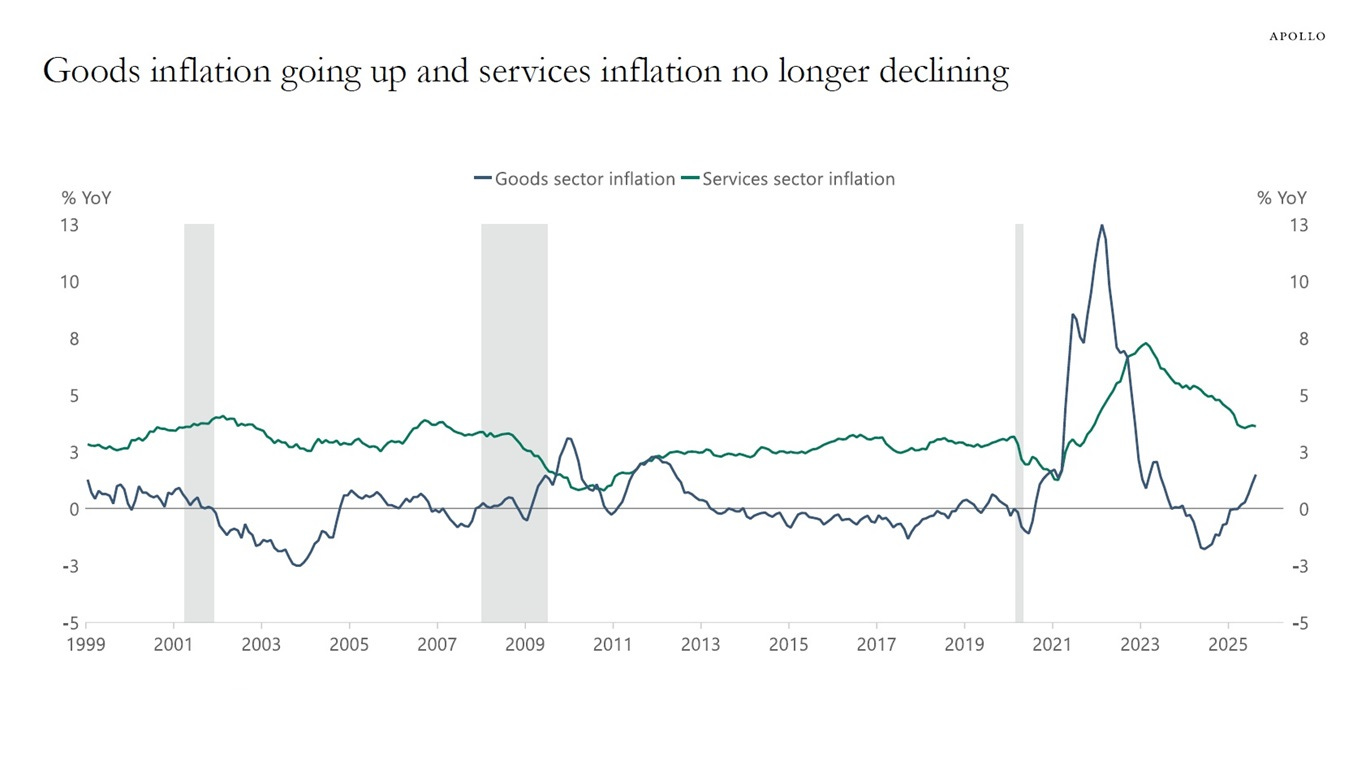

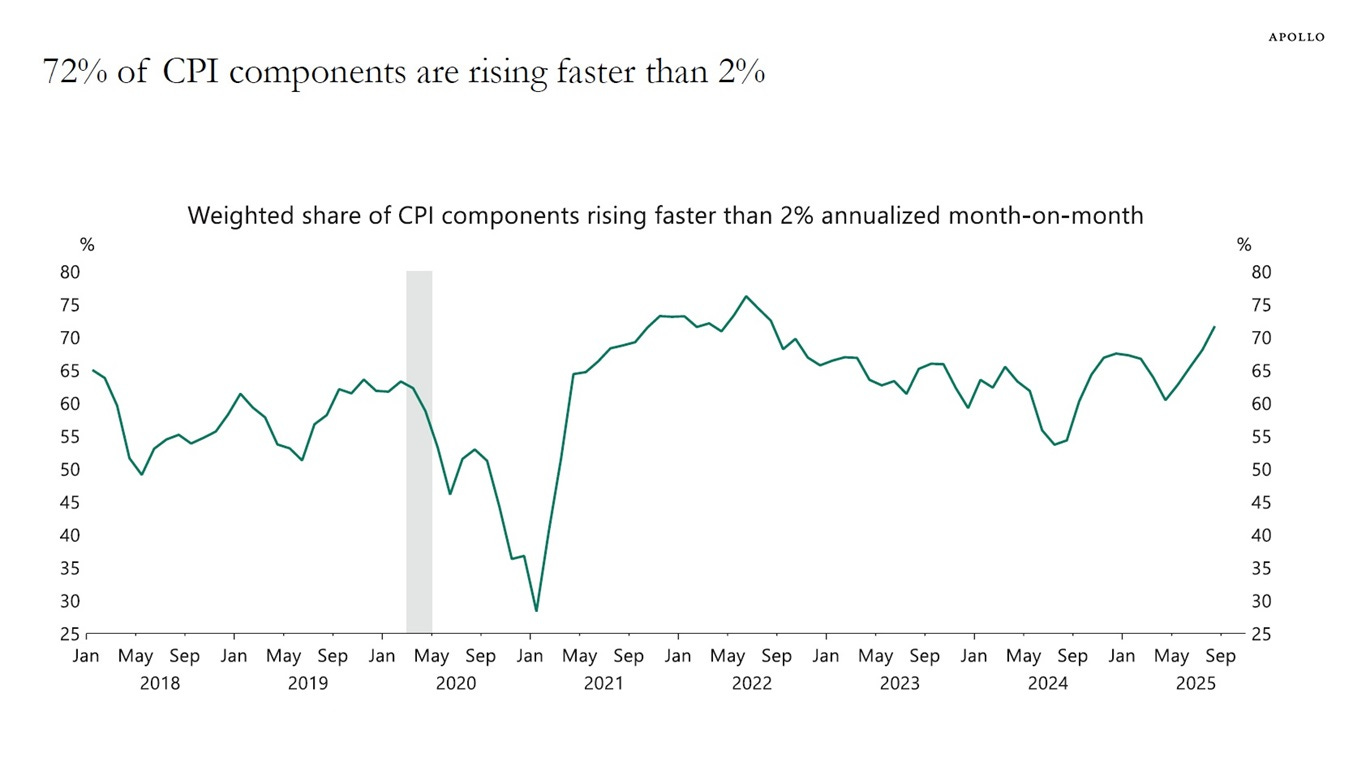

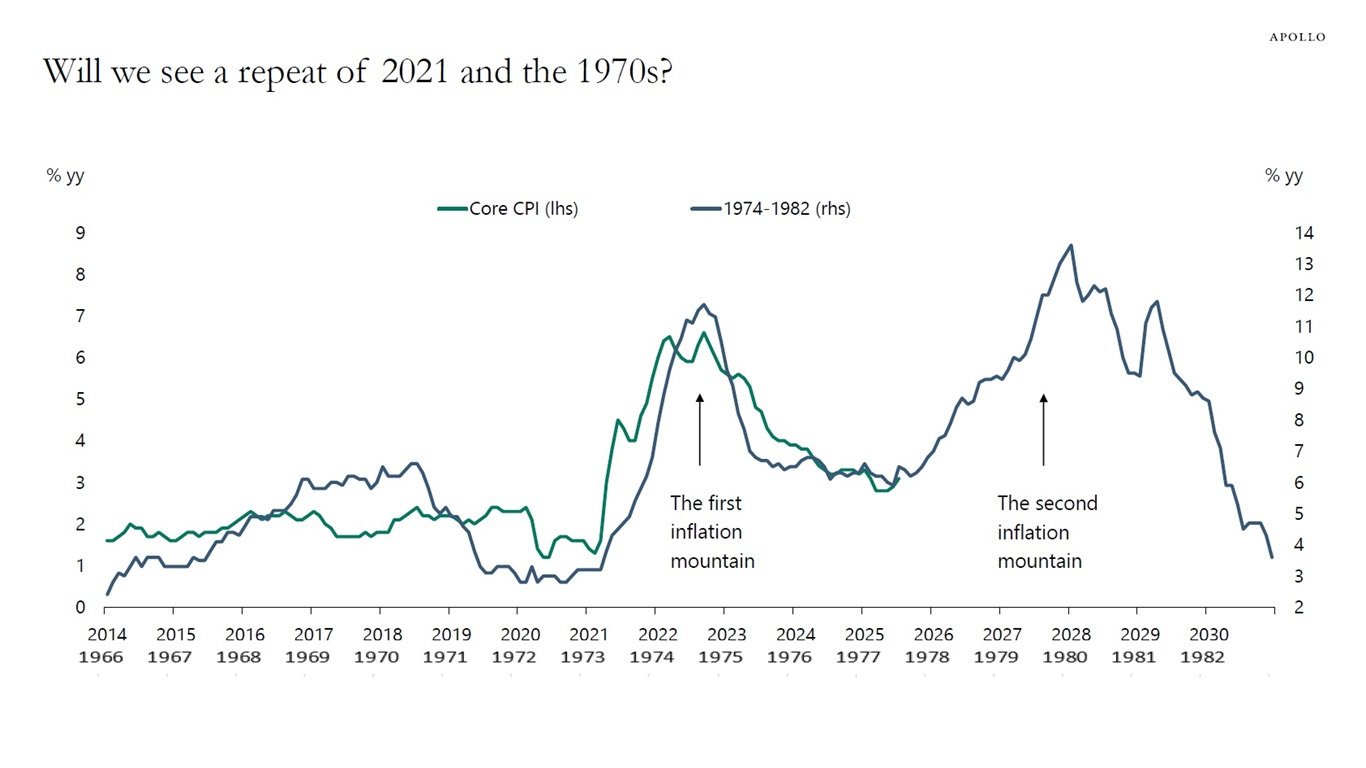

Torsten Slok, Chief Economist at Apollo Global Management, had two great charts this morning that does a great job illustrating a key theme I have been communicating over the past week. That is, disinflation has stalled and there is a real risk it remains that way or we see a reignition.

According to the data from Apollo, almost two thirds of the items used to calculate the CPI inflation rate are rising faster than the Fed’s 2% target.

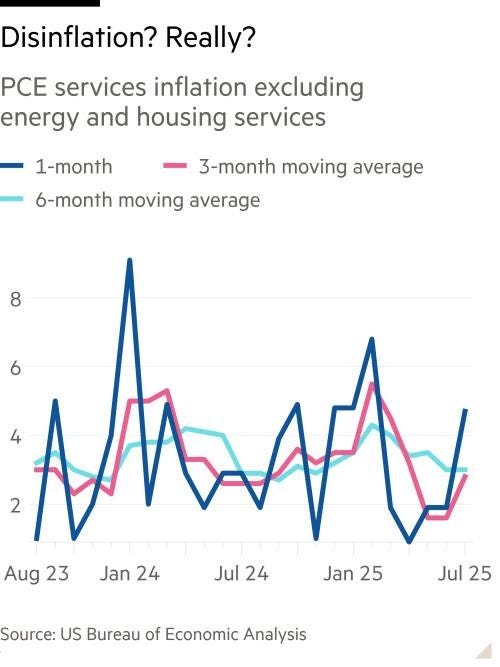

The PCE data isn’t showing a different story (PCE stands for personal consumption expenditure and is another inflation measurement—one that the Fed prefers to look at)

Unemployment Risks

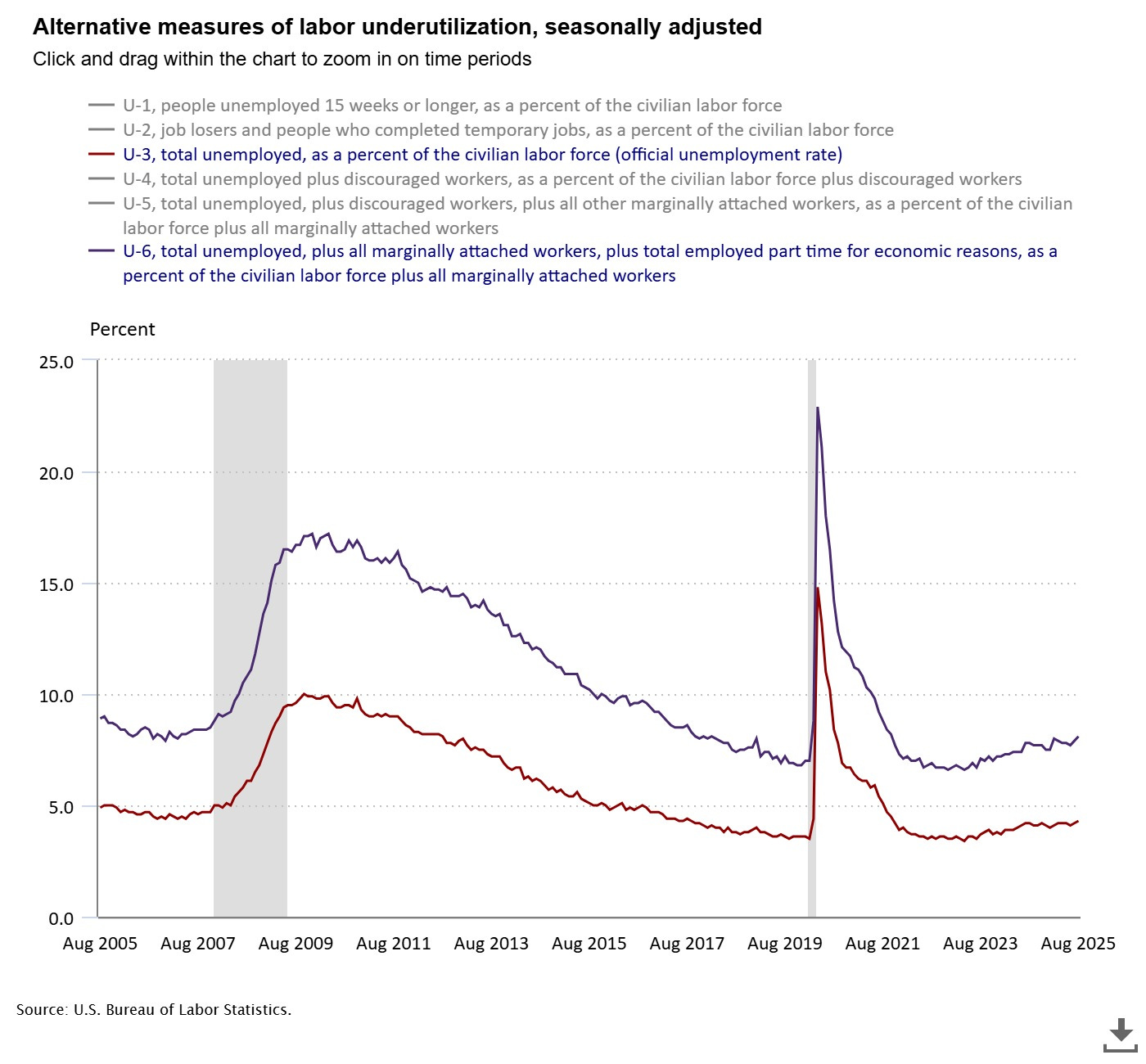

The unemployment rate in the U.S. is rising; the U-3 rate increased to 4.3% in August 2025. If we zoom out and look at the U-6 unemployment—the U-6 rate differs from the more commonly reported U-3 rate in that it also includes workers that are discouraged and underemployed—the number is naturally larger, at 8.1% and on a similar trajectory as the U-3 rate.

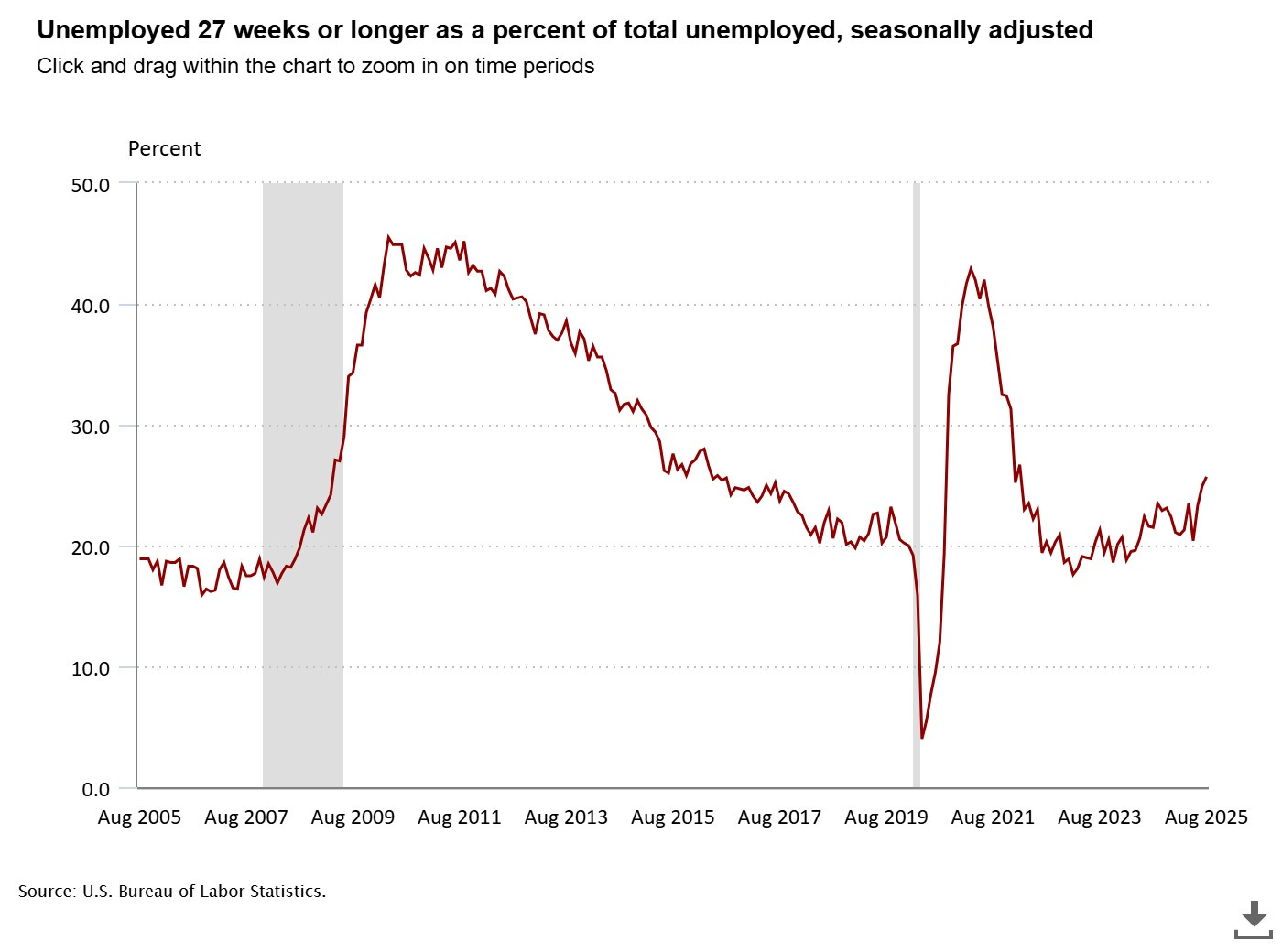

What is more concerning is the rate of increase in long-term unemployment, which jumped to 25.7% of total unemployed in August 2025 from 21.5% in August 2024.

Though these labor market trends are worth monitoring, I would note that the current levels are not historically high.1

Growth Risks

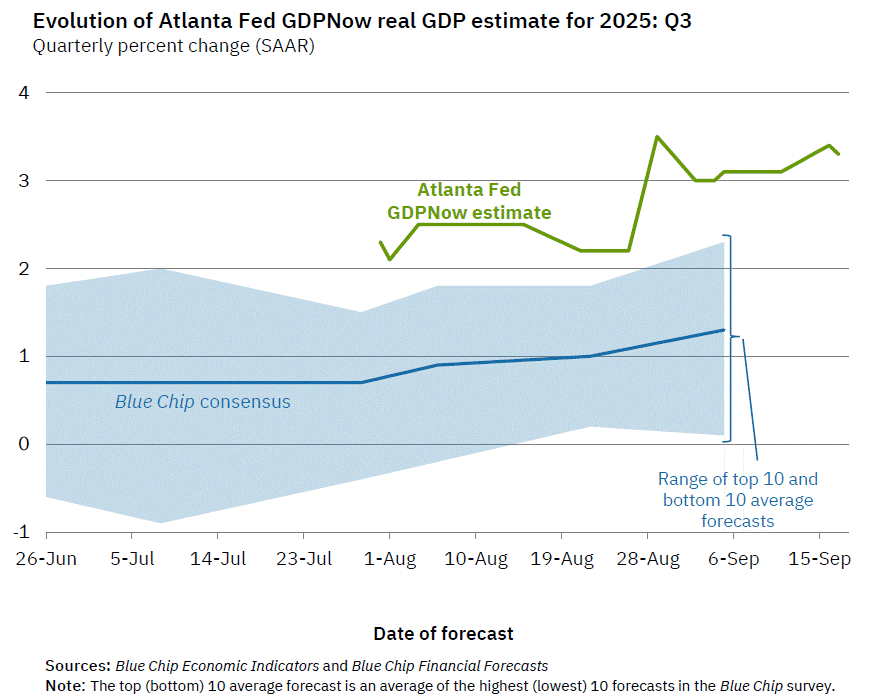

The key here is whether or not unemployment trends are going to lead to a slowdown in growth. At the moment, the Atlanta Fed’s GDPNow cast has been raising over the past few months and is now at an estimated 3.3% for Q3.

There is an important disclaimer to this estimate:

GDPNow is not an official forecast of the Atlanta Fed. Rather, it is best viewed as a running estimate of real GDP growth based on available economic data for the current measured quarter. There are no subjective adjustments made to GDPNow—the estimate is based solely on the mathematical results of the model.2

In conclusion, stagflation risks should not be ignored. Historically, it has proven to be a difficult cycle to break, often requiring aggressive interest rate hikes by the Federal Reserve (monetary tightening) and austerity-like measures—such as reduced government spending and/or increased taxes—to lower deficits and control inflation (fiscal tightening). While this combination doesn't guarantee a recession, it has often led to one. The last time the U.S. experienced a stagflation cycle, in the early 1980s, the resulting downturn was both deep and prolonged, thus making the following chart all the more sobering.

Current Unemployment Rates for States and Historical Highs/Lows - U.S. Bureau of Labor Statistics

GDPNow - Federal Reserve Bank of Atlanta