What If the Massive AI Spend Doesn’t Pay Off?

Companies in the U.S. have been shelling out records amount of capital on building out AI, and it's not just Big Tech. What happens if the large Capex doesn't pay off?

Last month, MIT researchers released a study showing that 95% of organizations—out of the 300 they analyzed—receive no return on their investment in AI. This is despite enterprises pouring an estimated $30–40 billion into generative AI. If accurate, the finding is significant: it implies billions of dollars are being misallocated rather than put to productive use in the economy.

The study did note, however, that companies purchasing AI tools tended to see more success than those building internally. That suggests the projected $364 billion in spending by AI superscalers this year could generate returns, as more firms opt to outsource instead of building in-house.

Even so, the sheer magnitude of superscaler spending is striking. Capex-to-sales ratios for the largest players now exceed 20%, compared with roughly 5% for the rest of the S&P 500. By some measures, the $155 billion spent in the first half of 2025 outpaced total U.S. consumer spending during the same period. Such levels of investment may be masking the true health of U.S. GDP growth. As I noted last week, stagflation risks are emerging via sticky inflation and rising unemployment. If growth is being propped up by technologies that fail to deliver productivity gains, those risks rise considerably.

To be clear, I am no AI skeptic. The technology is revolutionary. My concerns lie in two areas: (1) companies chasing hype and funding negative-NPV projects—often under faulty assumptions or to inflate share prices—and (2) investors chasing hype and bidding up the stock of any company linked to AI, regardless of fundamentals.

Today, AI infrastructure spending is roughly 1.2% of U.S. GDP. This is not unprecedented: in the 1880s, railroads—then a revolutionary technology—accounted for about 6% of GDP.

AI will almost certainly be the next railroad (and more), linking data and systems in ways we cannot yet fully grasp. Its potential is enormous. But it is precisely this excitement that risks fueling a dot-com–style bubble, one that only pays off after the hype fades and discipline returns—as it did in the aftermath of the 2000 tech bust.

Valuations are high

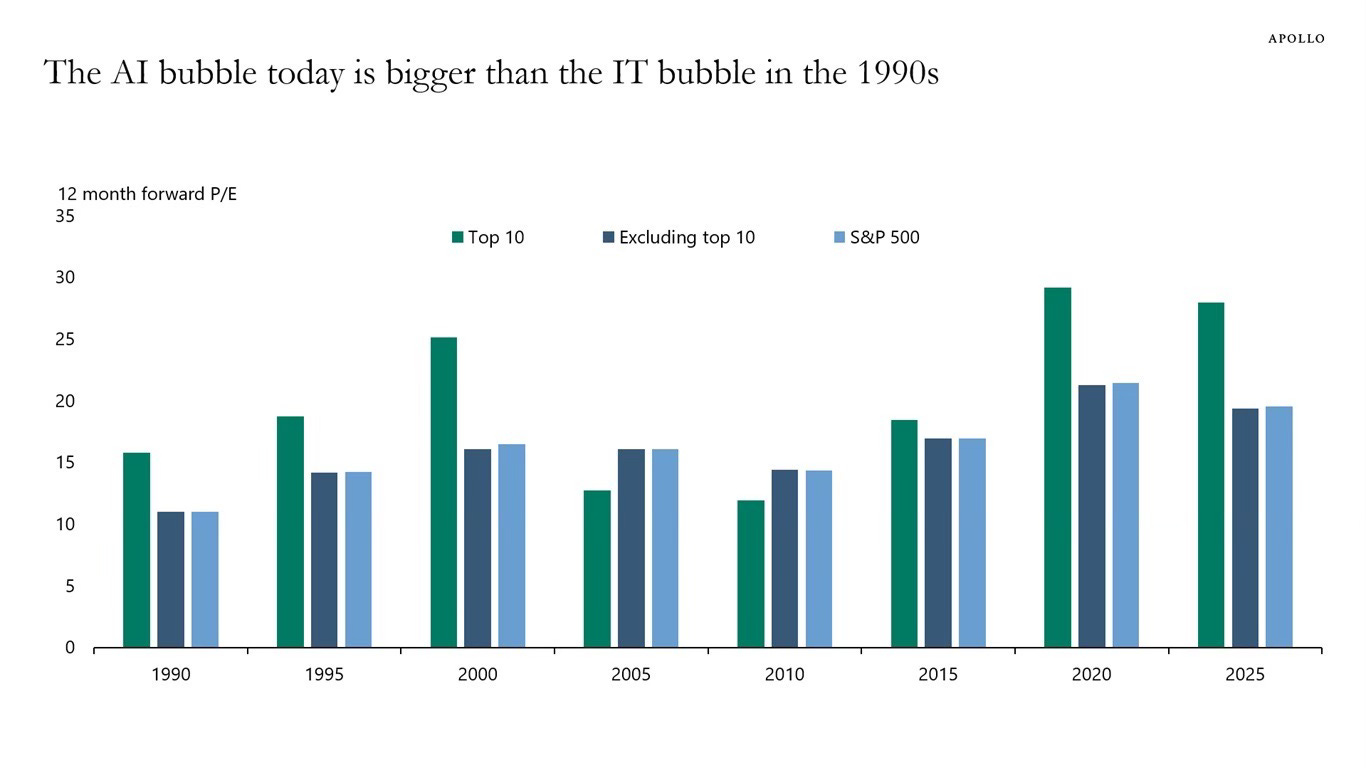

According to Apollo, forward P/E ratios—a widely used valuation measure—are now higher than they were during the 1990s tech bubble. Valuations are clearly at historic highs. What remains unclear is whether they are justified. That is yet to be seen. GenAI will undoubtedly create vast wealth over the coming decades, but the winners and losers of this race are still to be determined.

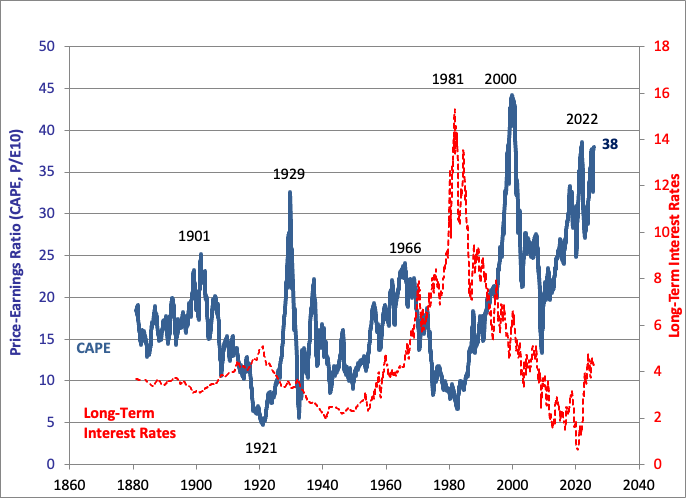

The Shiller CAPE ratio—developed by economist Robert Shiller—offers a more reliable gauge of market valuation. Rather than focusing on a single year’s earnings, which can be unusually high or low, it averages inflation-adjusted earnings over the past decade. This helps smooth business cycles and provides a clearer picture of whether stocks are cheap or expensive relative to long-term earnings power. Today, the ratio stands near 38x, approaching the 44x peak reached in January 2000, just before the market crash that began in March of that year.

Ultimately, the story of AI will be written over years, not quarters. The technology is revolutionary, but revolutions in productivity rarely happen on Wall Street’s timeline. For investors and corporate managers alike, the challenge is to separate hype-driven spending from sustainable value creation. If today’s massive capital outlays generate the productivity gains many hope for, the economy could enter a new era of growth. But if they don’t, the risks of inflated valuations, wasted capital, and stagflationary pressures will only grow. Either way, the stakes are big and worth watching closely.

Disclaimer

The content provided in this newsletter is for informational and educational purposes only and does not constitute financial, investment, or economic advice. The views expressed are solely those of the author and do not necessarily reflect the opinions of any affiliated organizations or employers.

While efforts are made to ensure the accuracy of the information presented, no guarantee is given regarding its completeness, reliability, or suitability for any particular purpose. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Past performance is not indicative of future results. All investments carry risk, and the value of investments may go down as well as up. The author is not liable for any losses or damages arising from the use of this content.

By subscribing to and reading this newsletter, you acknowledge and agree to this disclaimer.

Such a thoughtful take on AI investment, really enjoyed this!