Investment Memo #1 Part 2: Utah Medical Products, Inc. (NASDAQ: UTMD)

The investment model: LBO or Active Value

This post is a follow-up to my initial investment memo on Utah Medical Products, Inc (ticker: UTMD). You can view by clicking here.

The way I see it, there are three ways to generate a superior risk-adjusted return:

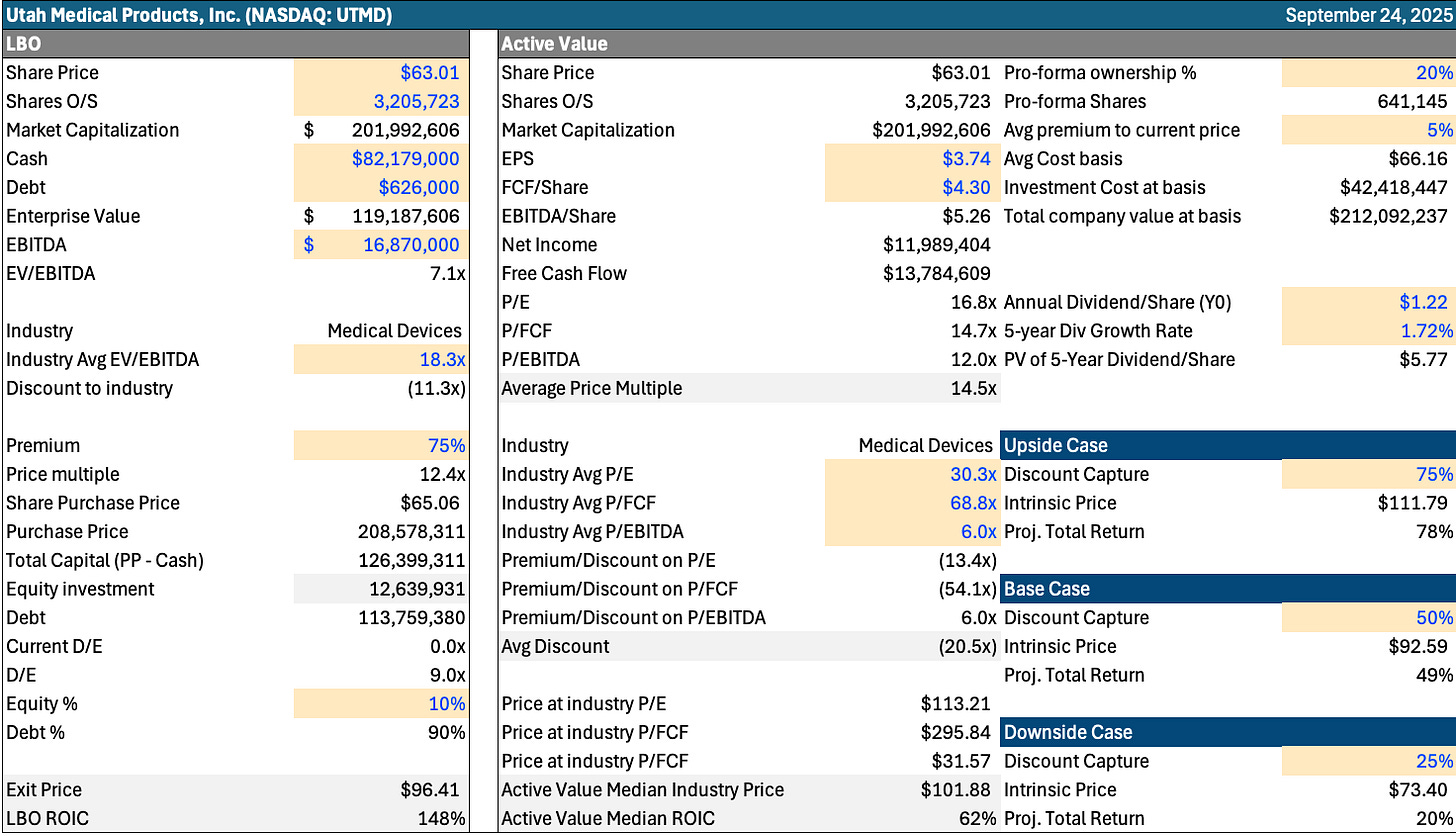

LBO - take majority control through a buyout (attractive given the large discount and practically zero debt on the company’s balance sheet)

Active Value - Buy it low on its cheap market price to fundamentals, however you will need to be active in creating a catalyst to close the Price/Value gap as the board and management are idle.

The third option is to buy in at the current discount and wait for another investor to come with a plan for one of the two previous options

Disclaimer

The content provided in this newsletter is for informational and educational purposes only and does not constitute financial, investment, or economic advice. The views expressed are solely those of the author and do not necessarily reflect the opinions of any affiliated organizations or employers.

While efforts are made to ensure the accuracy of the information presented, no guarantee is given regarding its completeness, reliability, or suitability for any particular purpose. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Past performance is not indicative of future results. All investments carry risk, and the value of investments may go down as well as up. The author is not liable for any losses or damages arising from the use of this content.

By subscribing to and reading this newsletter, you acknowledge and agree to this disclaimer.