Inflation Is Still Above The Fed’s Target

The economy is not out of the woods yet, inflation is still running hot (but not burn yourself hot) by the Fed’s standards and we could see a re-ignition.

I know I said this note would come next week, but I’m sending this out now because it felt like an incomplete thought that I needed to finish.

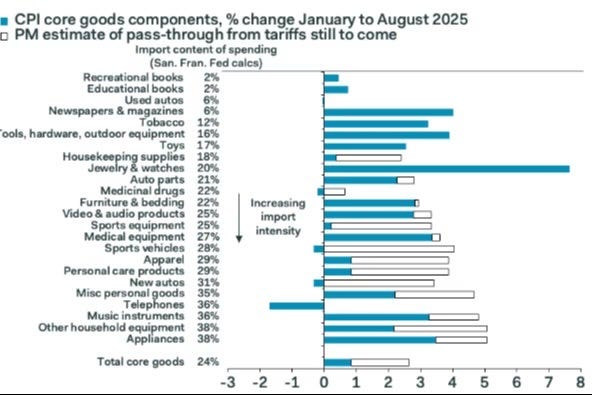

Whether or not you believe tariffs are inflationary (a debate currently being argued amongst economists), there is evidence to suggest that we haven’t yet seen most of them pass down through price increases to the consumer. However, producers of goods and services have been paying for them.

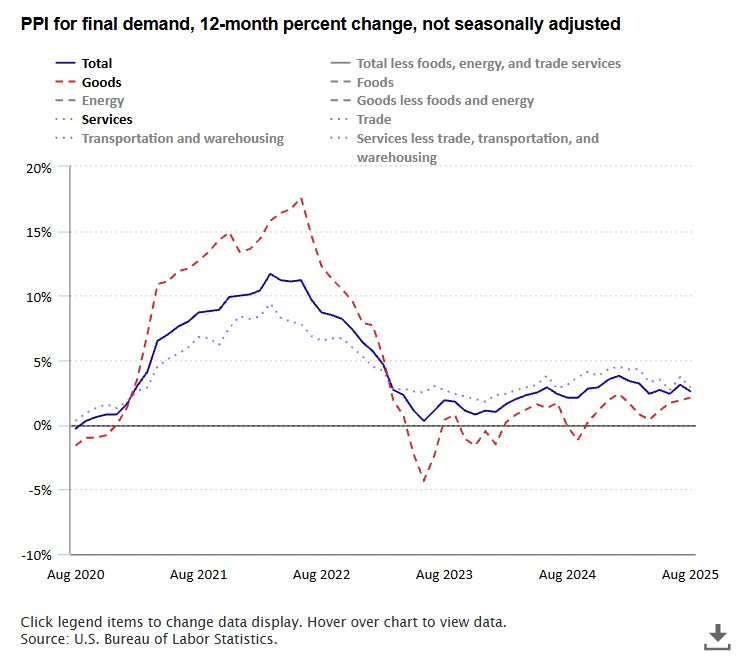

The Producer Price Index (PPI) is the inflation index for domestic producers. It is the inflation on raw materials, intermediate goods, and finished products at the wholesale level. Think of it this way: if the price of steel increases, car manufacturers must pay more for steel, which in turn increases the cost of the car they make with that steel. Whether or not producers pass on their increase in costs to the consumer is up to them (well, it’s up to Porter’s 5 forces—such as the bargaining powers of the consumer).

The fact of the matter is producers are experiencing higher prices almost across the board and soon they may begin passing those price increases onto consumers (see the first chart).

Great post! Clear breakdown of inflation trends. Since I work for a company that imports goods, I’d love to hear your take on how tariff increases are affecting the inflation dynamics of imported goods. Would be interesting to see your analysis on that.