Outlook* for 2026 (Part 1)

In traditional financial newsletter fashion, I'd like to provide my view on what could* be in store for the year.

I wouldn’t call this a forecast or any attempt at predicting what will happen this year, the piece will feature my notes on where things currently stand and what could play out. It is more like trend analysis (and will probably hopefully read like such).

There are a couple reasons I like to have an outlook for the year:

(1) My investment philosophy is based on fundamental value investing, but I believe in a hybrid approach to analysis and researching ideas in my investment universe. I primarily make investment decisions based on a company’s true value and its long-term outlook, while looking to pay a reasonable price. I believe in order to understand a company’s long-term outlook and whether you are paying the right price, you must be well researched on the current market environment.

(2) I do make some investment decisions based on tactical opportunities, which are shorter-term special situations for alpha typically driven by temporary dislocations, liquidity conditions, or macroeconomic shifts, as opposed to company-specific long-term value.

(3) Because just like I believe it’s important to set goals personally and professionally, I think it’s important to have a viewpoint based on convictions, while being objectively open and honest with yourself.

*I can guarantee you things will change as the year goes on1. This is more of a lay of the land than an outlook.

Definition: lay of the land

the features or characteristics of an area.

the current situation or state of affairs.

What happened in 2025

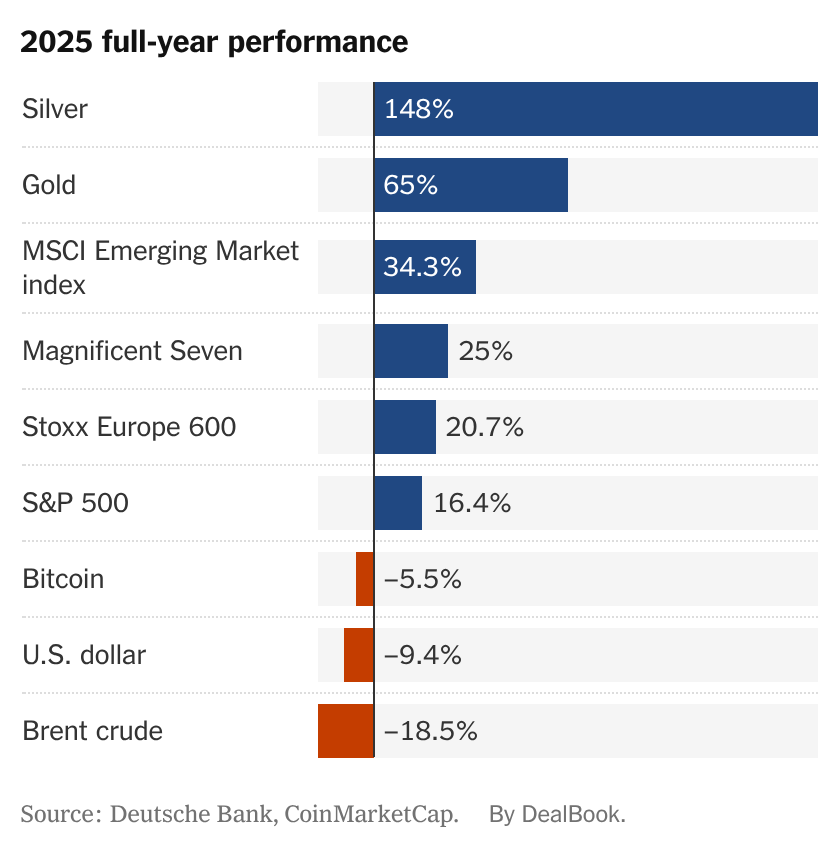

Is it time to start smelting your sterling silverware? Silver and Gold broke records reaching their highest values in history (in dollar terms).

Bitcoin didn’t act like digital gold at all…at least not compared to actual gold.

Emerging markets and European stocks outperformed the S&P 500. Actually, the world2 outperformed the S&P 500 (which still returned 16.4%, its third straight year of double-digit growth).

What about the tariffs?

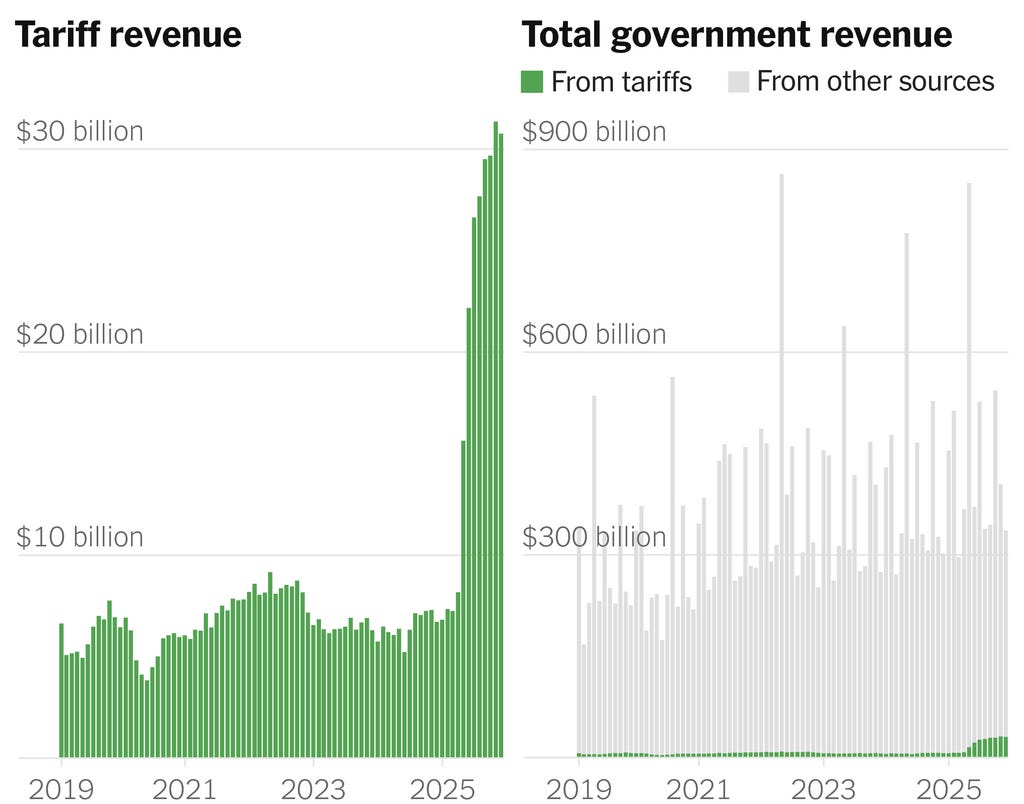

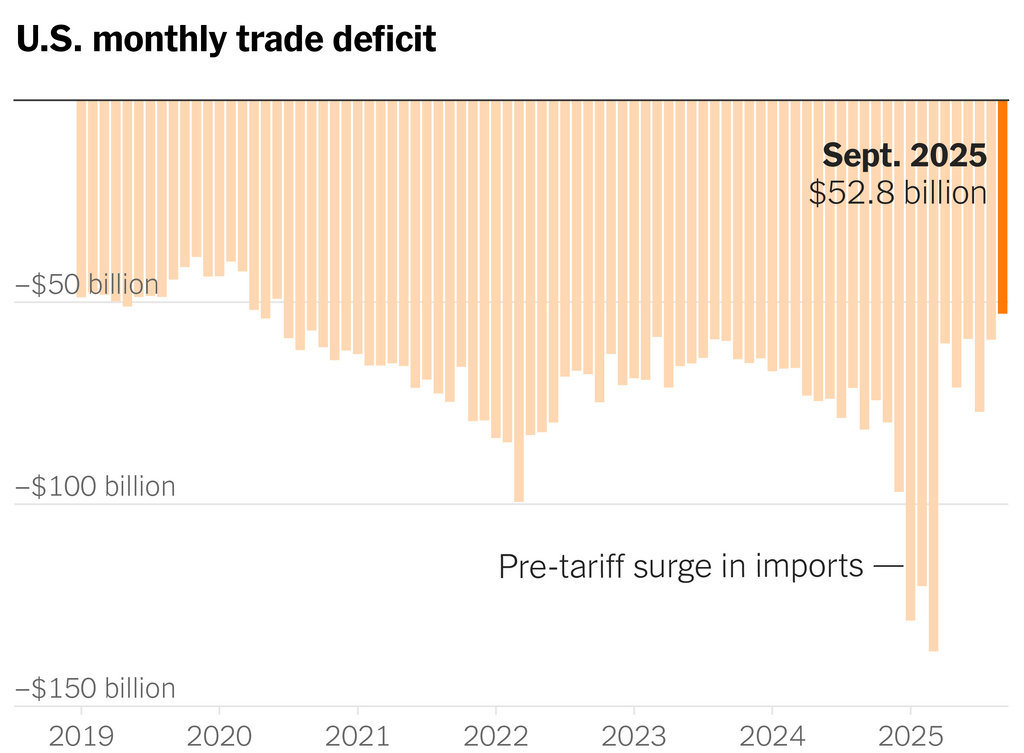

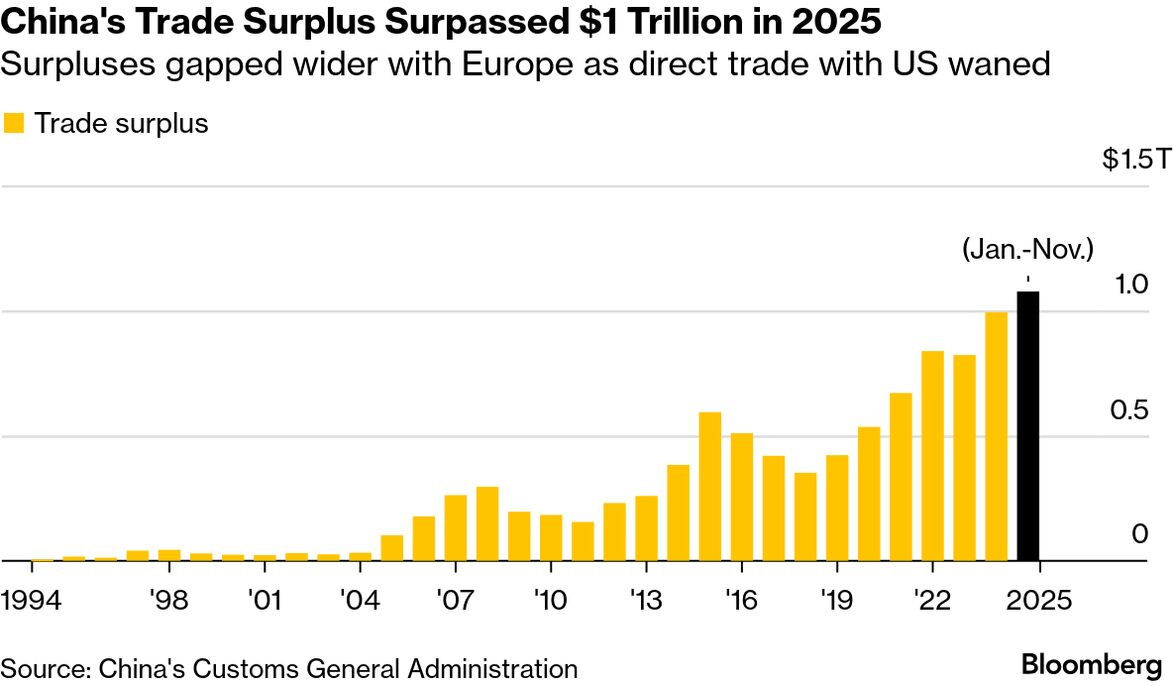

No seriously, what about them? We made $30 billion, sure, but let’s remember the U.S. treasury had $5.23 trillion in revenues for 2025. So far this year (fiscal year 2026, which started in October 2025), they’ve pulled in $740 billion3. Not to mention China, our largest trade partner, has been unaffected. They’ve redirected most trade to other countries that are happy to fill the gap (and use them as middlemen to sell to the US at lower tariffs rates).

The Macro Regime

Unemployment

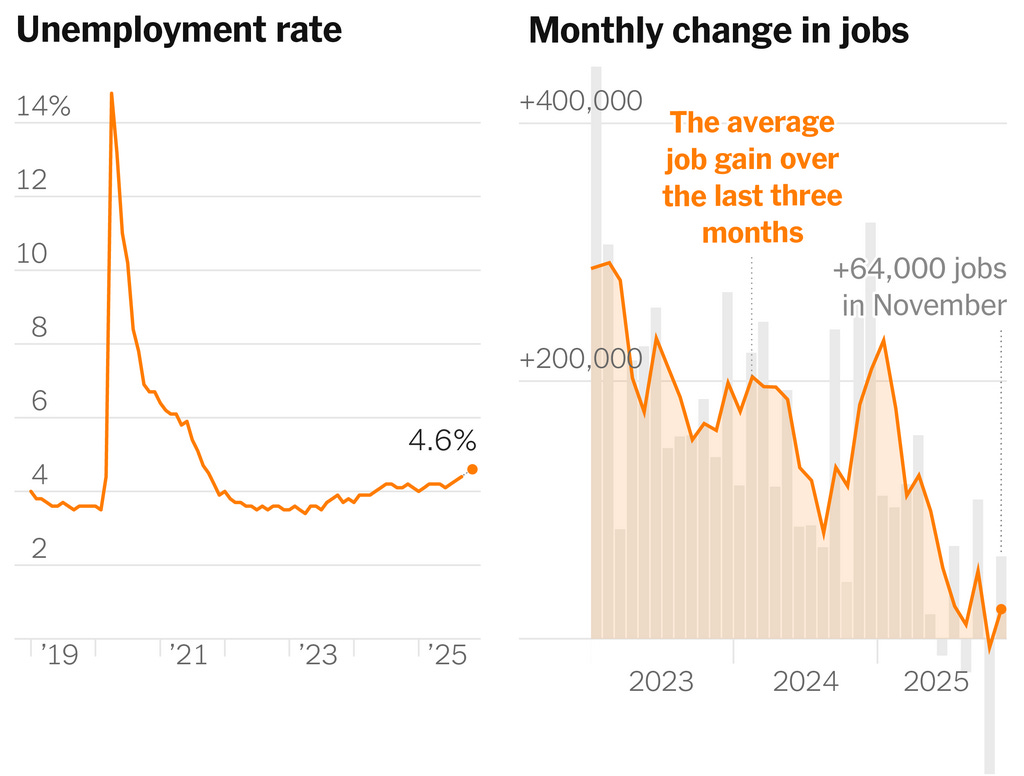

Well… it’s not terrible (historically speaking) but as I said, we’re doing trend analysis here and it’s clear the job market is deteriorating. The unemployment rate returned to its pre-COVID level and now rising higher again.

Inflation

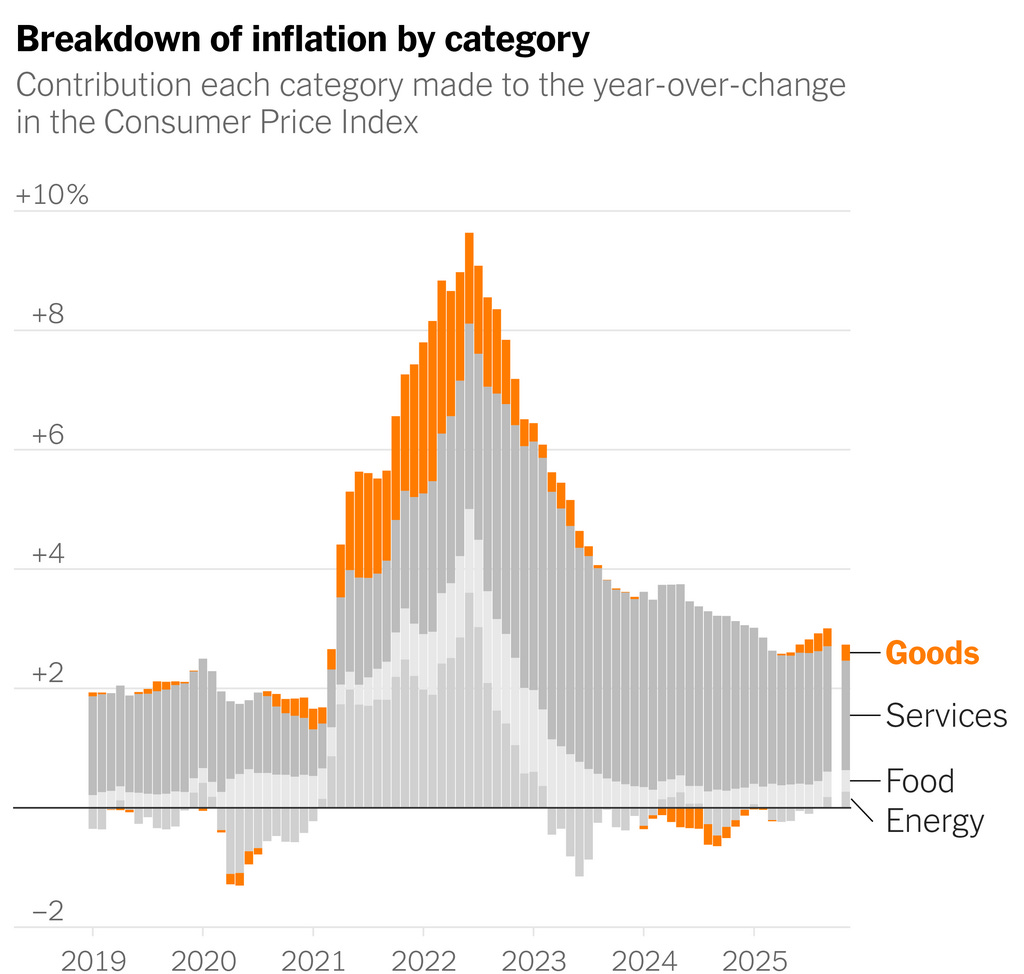

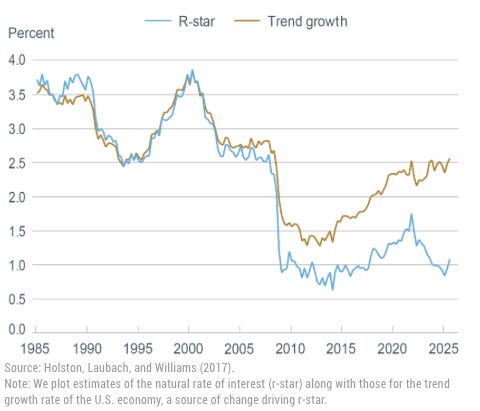

We’re still at 2.7% YoY as of November 2025. The Fed targets an average annual 2% and they seem to have paused around their own calculation4 of the natural rate of interest* (r-star). With R-star at 1.1% and inflation at 2.7%, the nominal natural rate is 3.8%. The Fed Funds rate target is currently 3.5% - 3.8%.

*The natural rate of interest (r*) is the theoretical real (inflation-adjusted) interest rate where the economy is at full employment with stable inflation, acting as a neutral point for monetary policy. In English: the healthy level where the economy can operate and grow without the need for rate hikes or rate cuts from the Fed (i.e. it’s balanced).

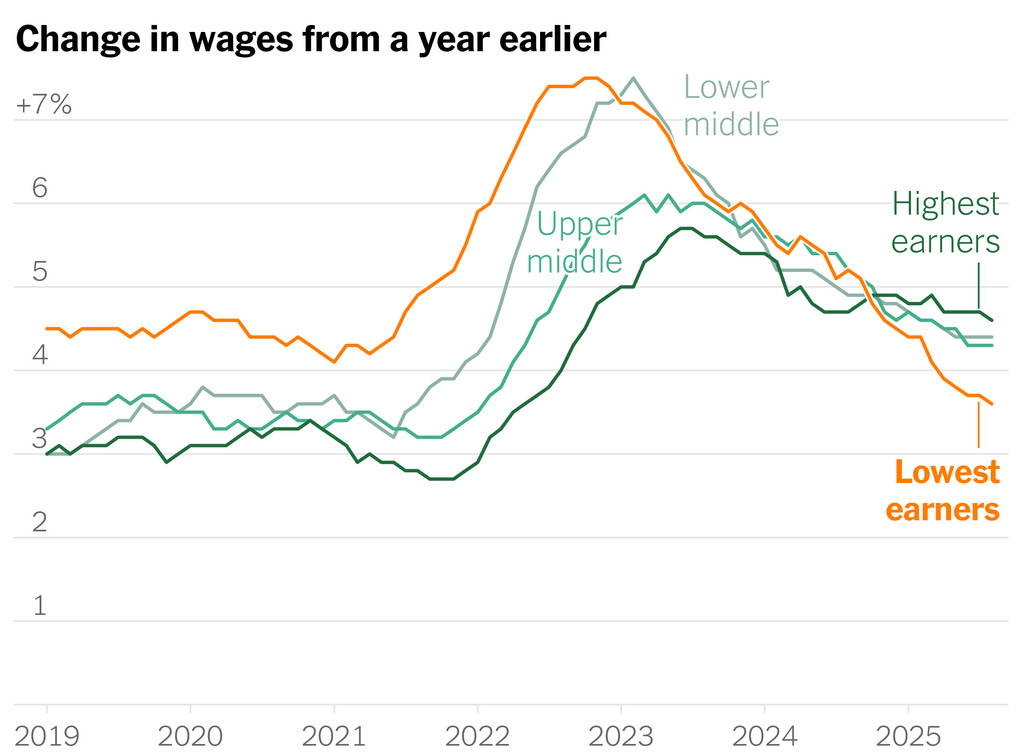

Another good sign for the inflation trends (but not so much for the bottom 90% in the K-shaped economy) is wage growth is declining to pre-COVID levels.

Fiscal Budget

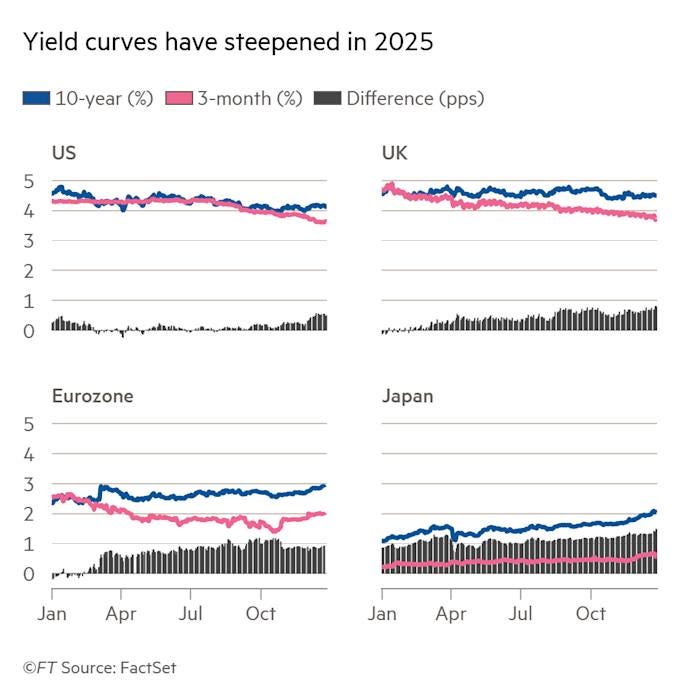

Investor are starting to demand more in term premium (the yields for longer term bonds) to fund governments, but they haven’t been as pushy in the U.S., yet.

Market Implications

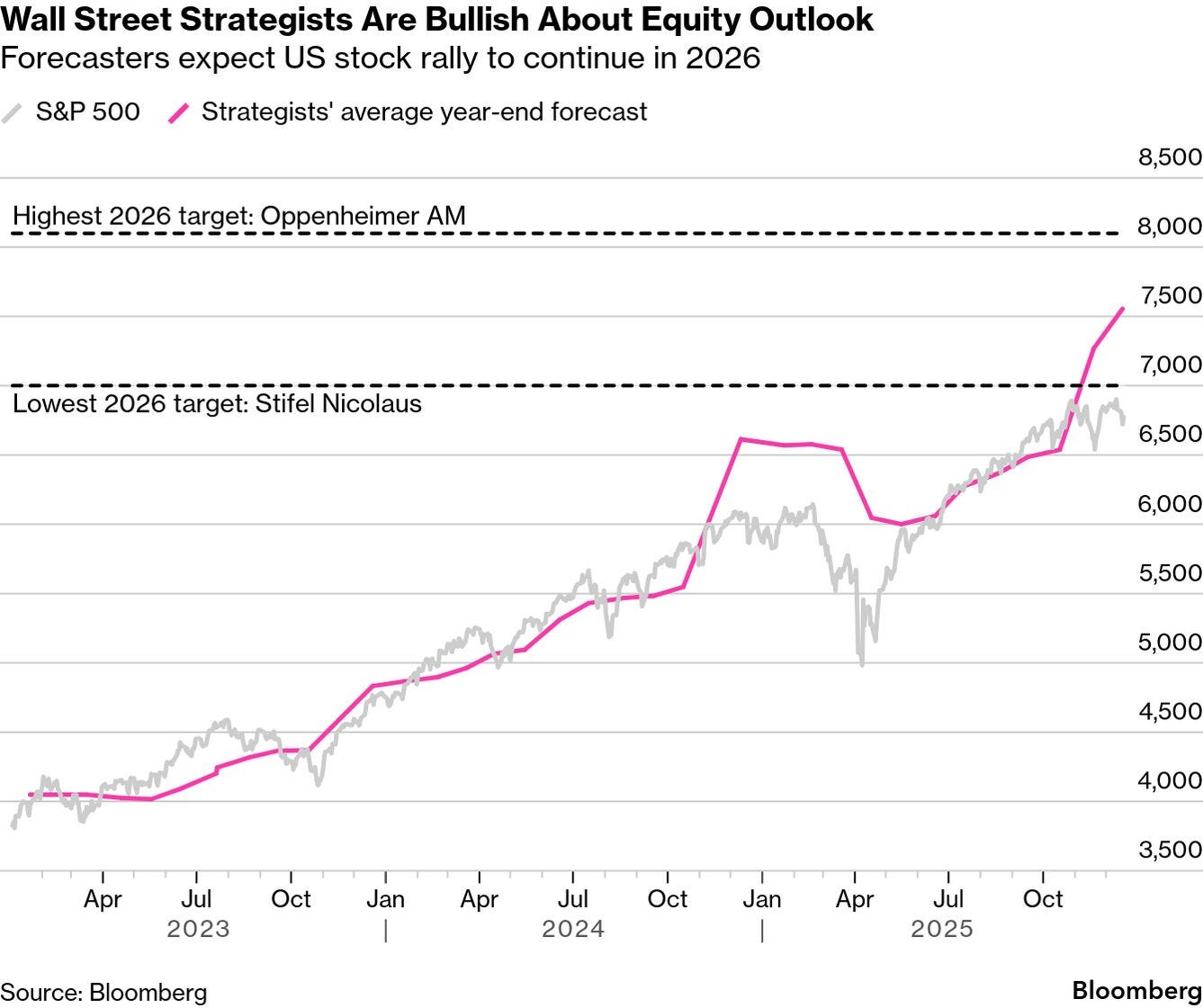

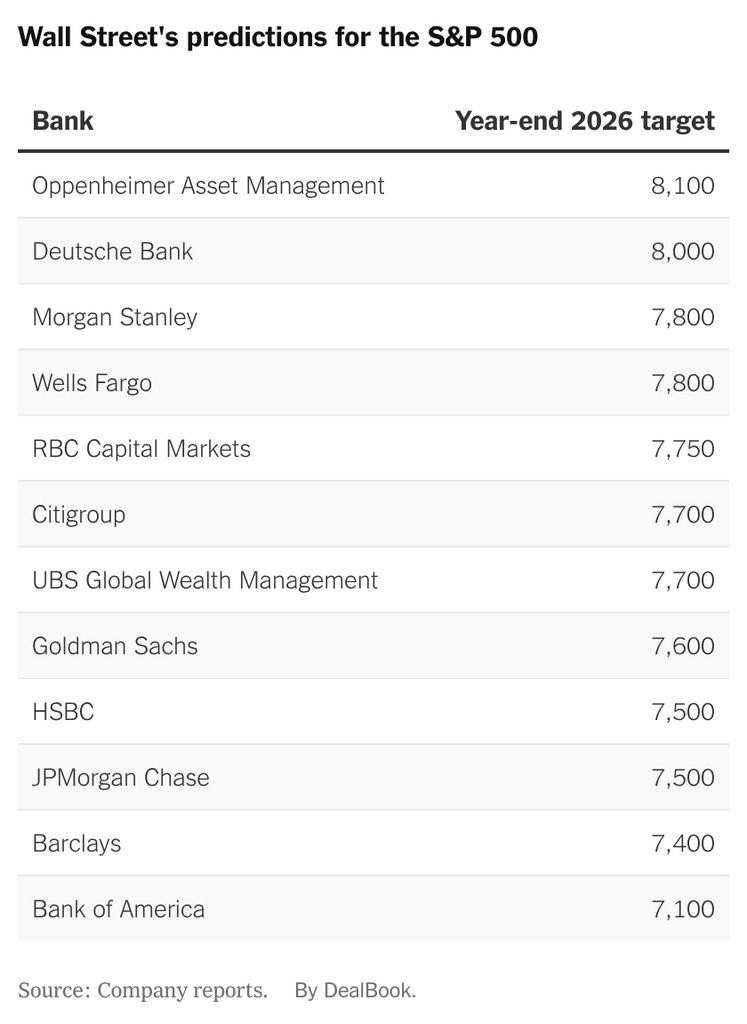

Wall Street’s Forecasts

Everyone on the street seems happy to forecast more boom times in 2026.

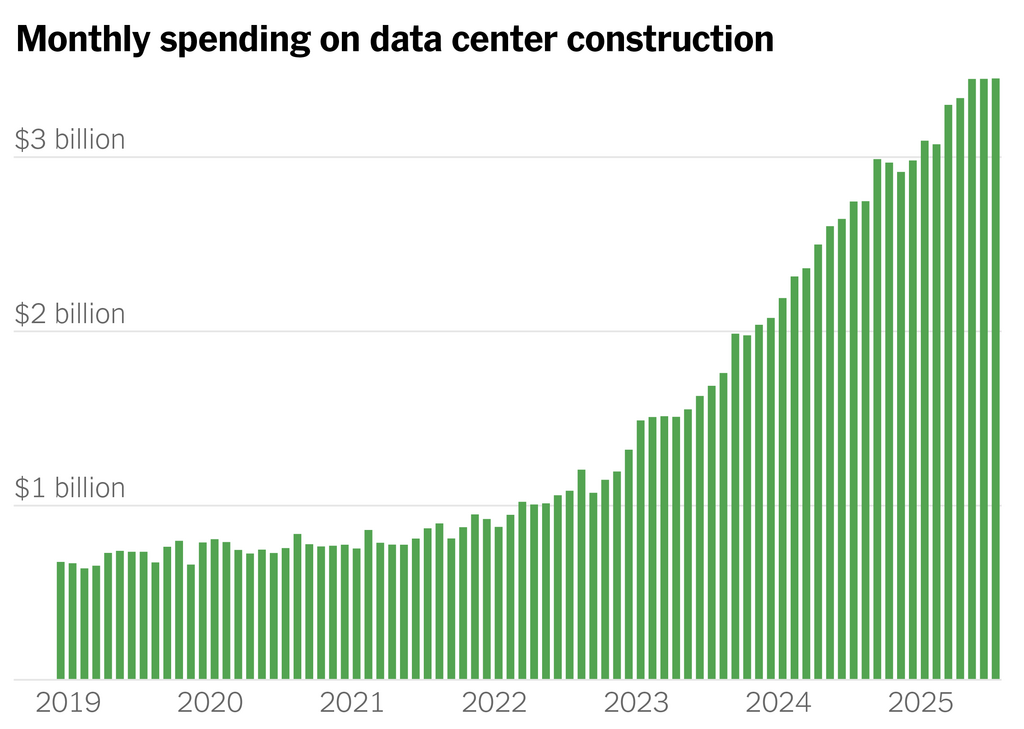

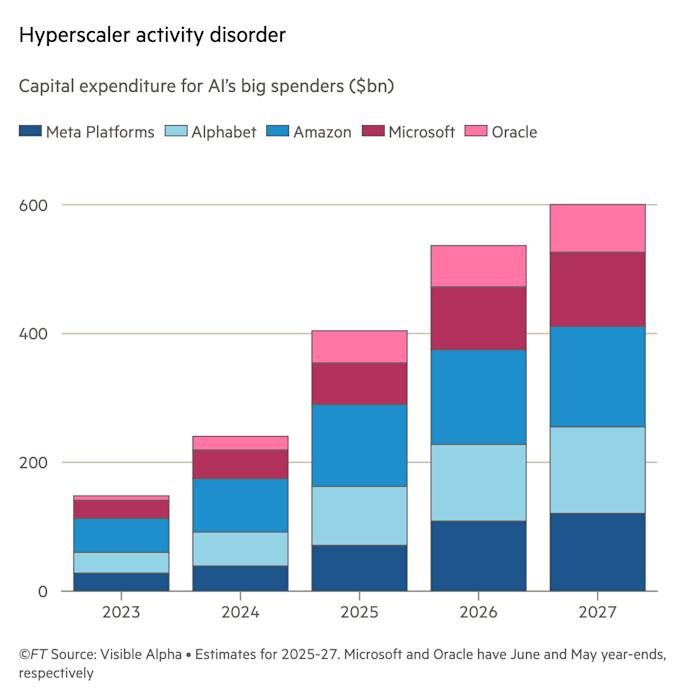

What are they most excited about? That beautiful upward trend in billions upon billions (to trillions) in capital spending on AI infrastructure.

Valuations

I won’t beat a dead horse here, but things are expensive.

Where Risk is Mispriced

To be continued… Part 2 coming next week.

Appendix

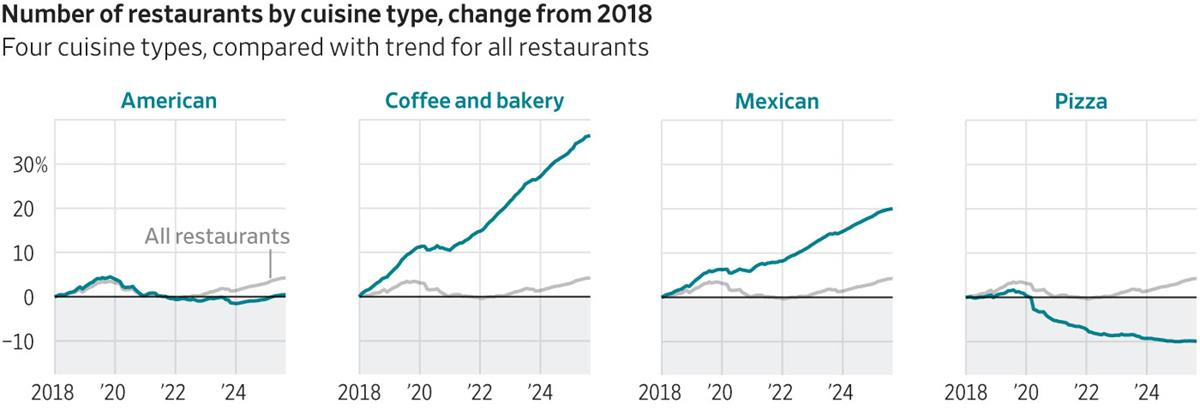

A trend I was really surprised to come across, pizza restaurants are on the decline. What is happening to the world…

Disclaimer

The content provided in this newsletter is for informational and educational purposes only and does not constitute financial, investment, or economic advice. The views expressed are solely those of the author and do not necessarily reflect the opinions of any affiliated organizations or employers.

While efforts are made to ensure the accuracy of the information presented, no guarantee is given regarding its completeness, reliability, or suitability for any particular purpose. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Past performance is not indicative of future results. All investments carry risk, and the value of investments may go down as well as up. The author is not liable for any losses or damages arising from the use of this content.

By subscribing to and reading this newsletter, you acknowledge and agree to this disclaimer.

I certainly didn’t foresee the US launching a surprise midnight operation to capture the Venezuelan president last Saturday. Venezuela has the largest oil reserves in the world, so what happens now will surely be consequential.

Hyperbole

Check the clock: https://fiscaldata.treasury.gov/americas-finance-guide/government-revenue/

https://www.newyorkfed.org/research/policy/rstar

Pizza on the decline???… We’re doomed!