Outlook for 2026 (Part 2)

The economy is providing a narrow path for markets, with little room for error

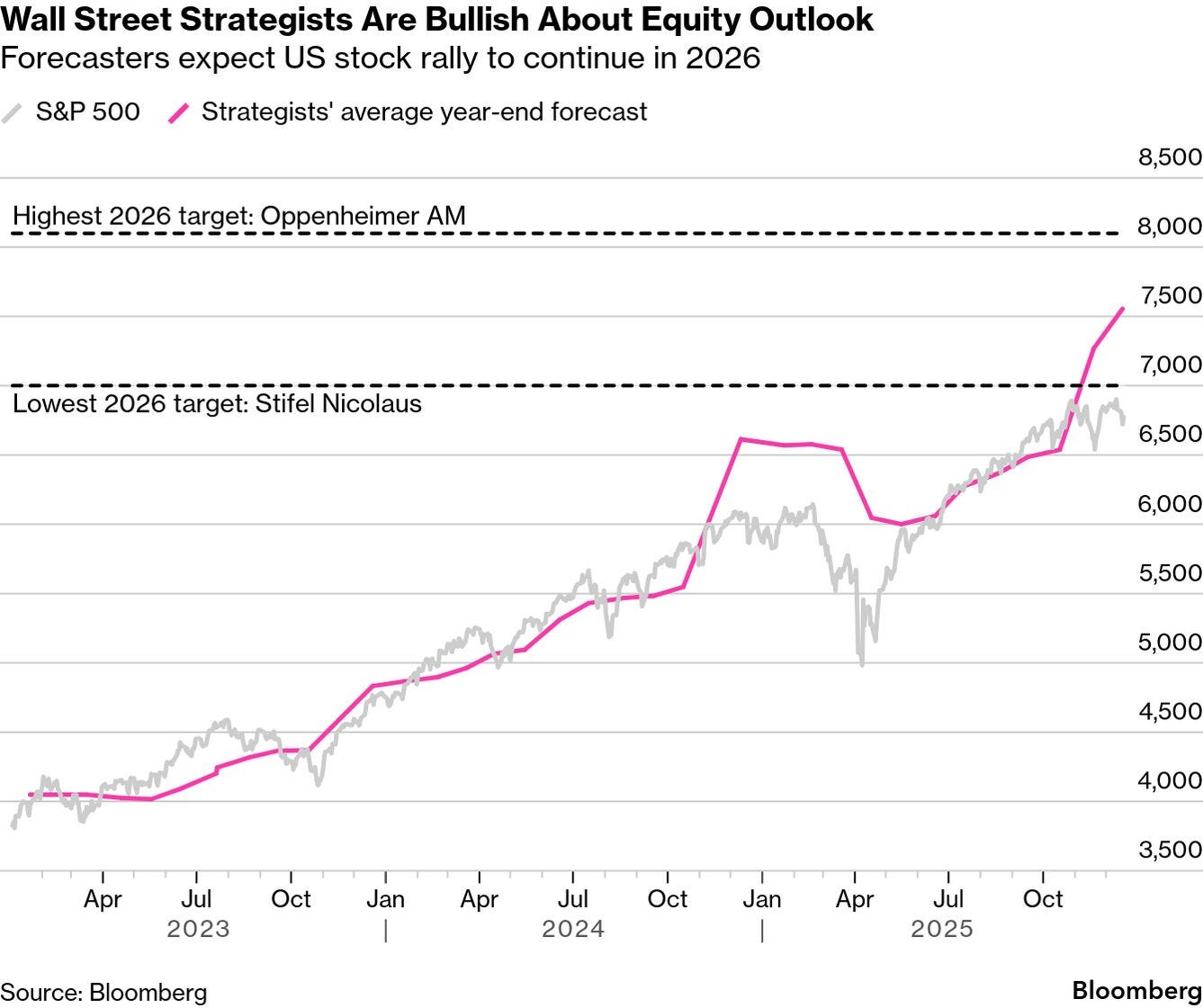

Part 1 of Notes on the Market’s “Outlook for 2026” can be summed up like this: The economy did well, but the labor market is weakening and inflation is stuck; tariffs haven’t really solved anything, but they haven’t caused much damage either; the U.S. stock market returned 16% last year and still significantly underperformed non-US stocks and gold (it’s even worse if you’re a foreign investor, for example if you’re a European investor, the S&P only returned 4% given the depreciation of the dollar against the euro); the US government and other developed countries continue to spend too much and investors are demanding more in term premium (higher interest at longer duration treasuries); everything is expensive on a multi-decade comparison but wall street forecasts all expect growth in equities this year…

That pretty much covers it, but if you’d like to read Part 1 (and take in the beautiful charts I provided) you can do so here:

Okay… now where could the risks be mispriced?

Inflation

I believe the upside risks to inflation are still being miscalculated. There are still a few headwinds (or I suppose tailwinds?):

A dovish Fed pushing interest rates down too low and overheating the economy which reactivates inflation.

Tariffs began to take a toll (or Trump follows through with the really impactful ones he threatened but backed away from), causing a cost-push effect to prices by raising production costs.

The One Big Beautiful Bill tax cuts will put more money in people’s pockets, possibly sparking a demand-pull effect to prices (and the stimulus checks Trump keeps mentioning will only increase this risk).

The US federal government continuing to run huge deficits coupled with easing monetary policy that strain the economy even further.

Unemployment

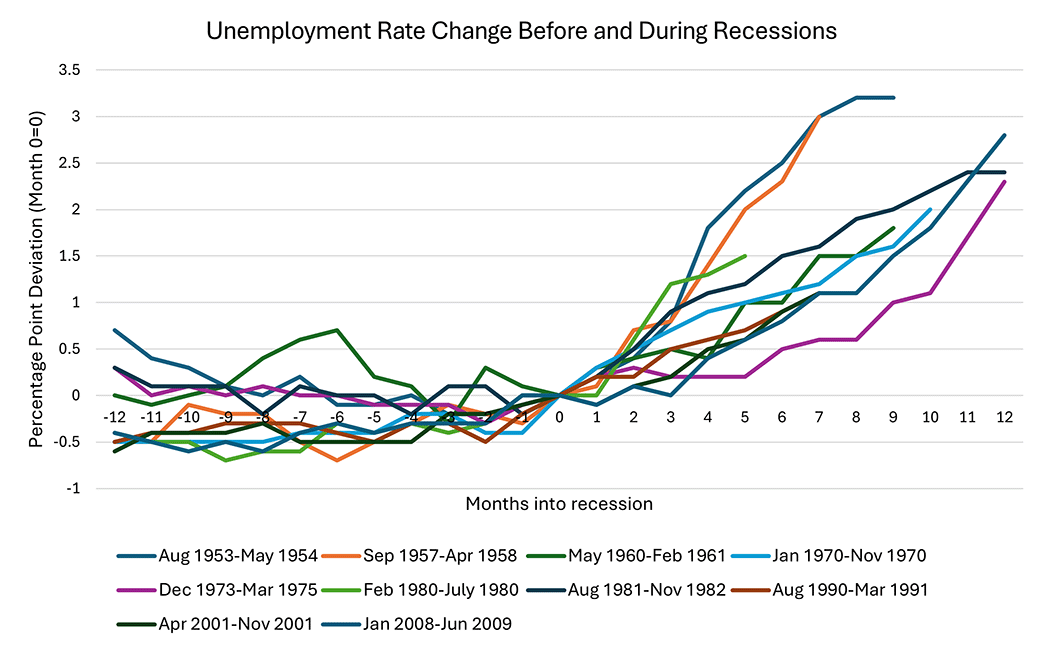

Unemployment tends to “rise gradually, then suddenly” according to data from the Richmond Fed1. They didn’t include the Covid recession (for obvious reasons), but the chart below shows a common theme over the last 11 recessions. Of course, this data assumes we see a recession.

Recession Probability

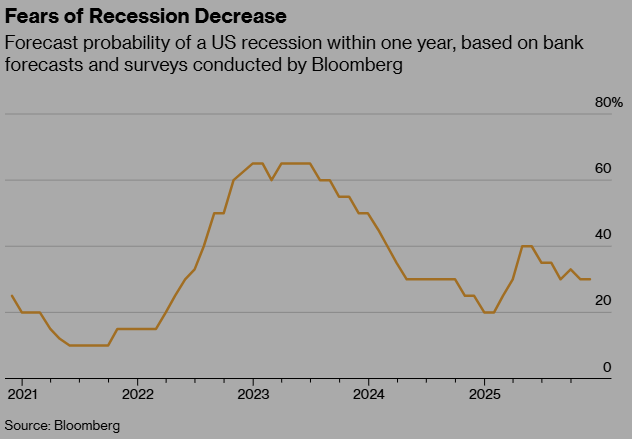

Will we see a recession? after a sharp increase last year after “Liberation Day”, the probability based on forecasts and surveys from Bloomberg have declined to less than 30% chance. (please ignore the dark tint to the graph)

Growth

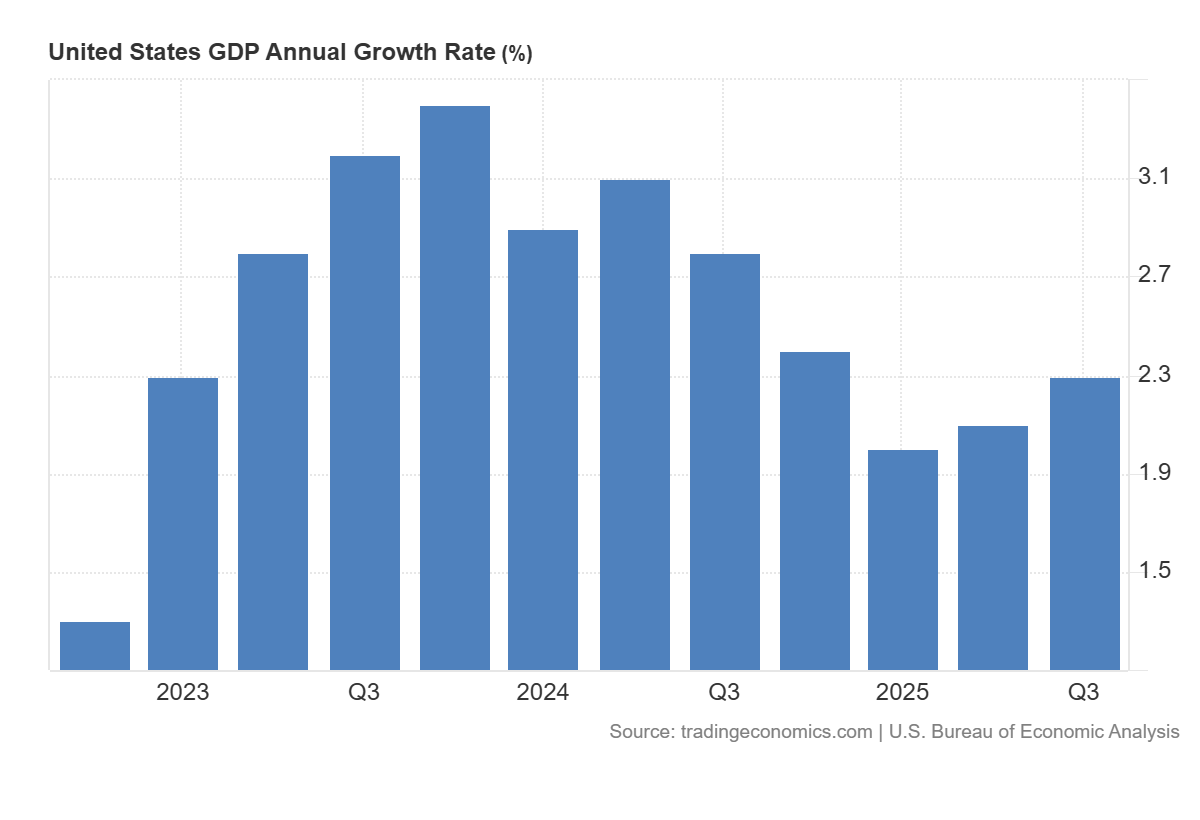

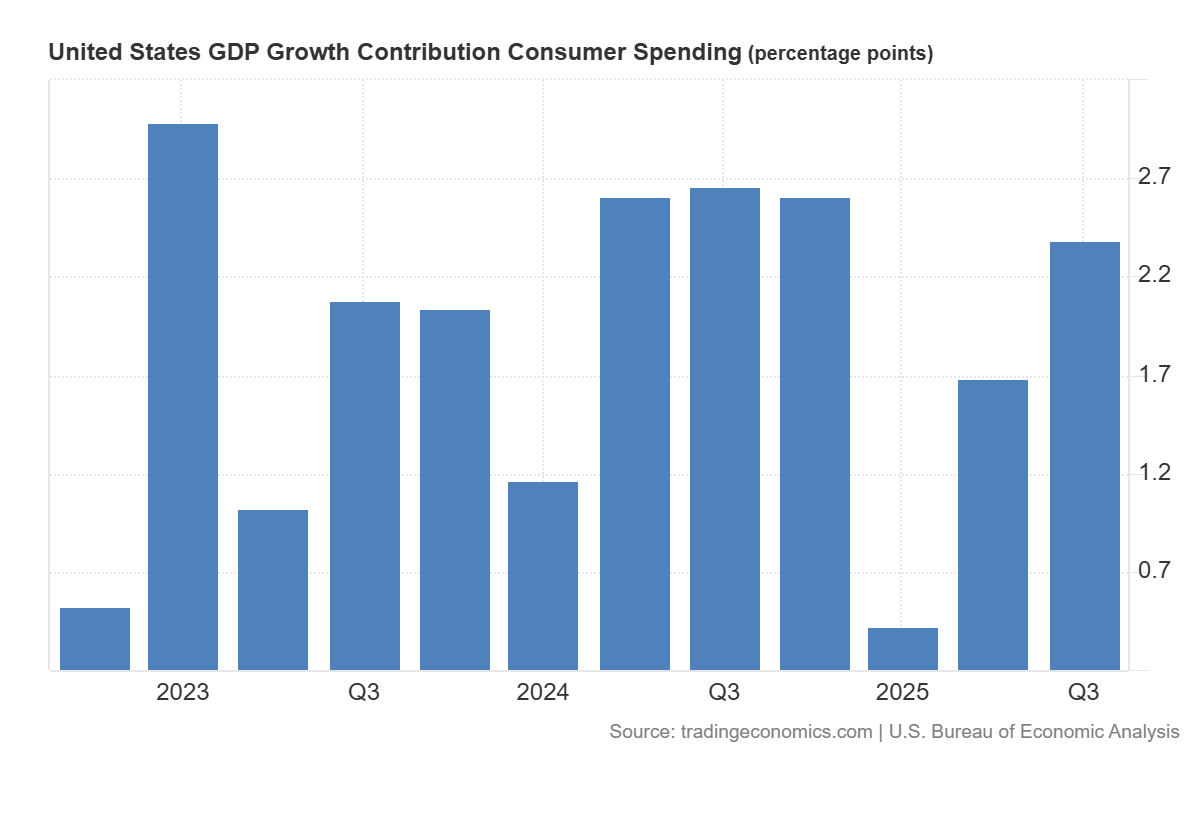

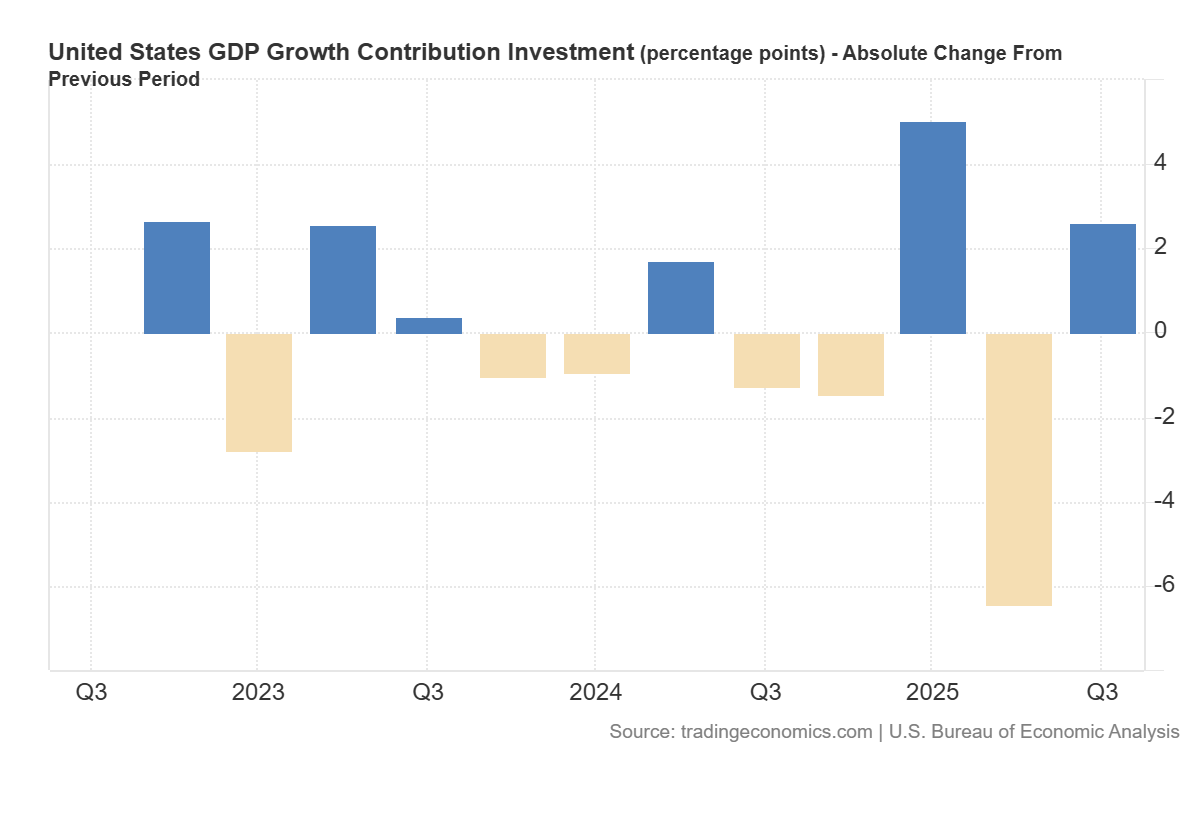

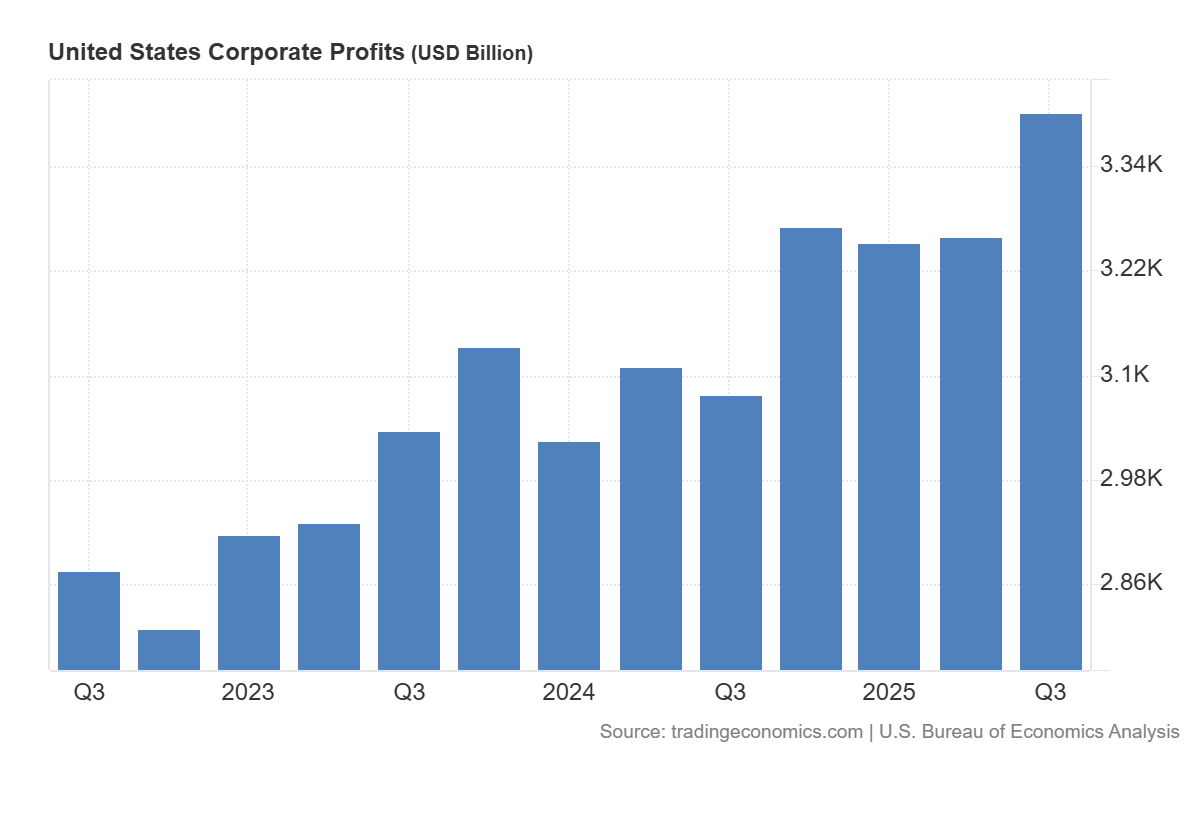

To be sure, the economy does look good. The US GDP annual growth rate was 2.3% as of 3Q25. Profit growth continues. Consumer spending is strong, growing 2.6%. Business investment is strong? Fixed investment was 2.6% but as I’ve discussed here and here, AI certainly has everyone excited and they’re investing gigantic sums to build it, but we need clarity on the business models.

Risk Assets

Analysts across the street have the S&P 500 moving higher. The Shiller Cape ratio shows US equity valuations are stretched (and it’s not just Big Tech; Costco’s forward P/E is 46x, Walmart’s is 42x, Starbuck’s is 38x and they’re expected earnings growth is 12%, 11%, and -14%, respectively).

Credit spreads are ultra tight, which signals complacency and possible miscalculations of the risks to the economy. If this reverses, it could lead to a feedback loop:

Spreads widen, borrowing costs rise

Investment and hiring fall

Growth slows

Defaults increase

Spreads widen further

So where does this leave us?

Taken together, this is not an environment screaming “imminent recession,” but it is one where risks appear asymmetrically skewed. Markets are priced for continued growth, benign inflation, and orderly disinflation in rates, all at the same time. That’s a narrow path.

If inflation re-accelerates even modestly, the Fed’s room to cut disappears just as growth momentum slows. If unemployment follows its historical pattern and rises “suddenly,” credit spreads are not remotely prepared for it. And if fiscal dominance continues, large deficits alongside easier monetary policy, longer-duration assets may struggle regardless of near-term growth.

In other words, the base case looks fine, but the tails look fatter than markets are pricing.

That doesn’t mean risk assets will sell off tomorrow. It does mean expected returns are likely lower, volatility is underpriced, and diversification matters more than it has in years. When everything is expensive, “being right” matters less than not being wrong in the same way as everyone else.

The market may well grind higher from here, but if it does, it’s doing so with very little margin for error.

And that’s where I think the real risk lies.

Disclaimer

The content provided in this newsletter is for informational and educational purposes only and does not constitute financial, investment, or economic advice. The views expressed are solely those of the author and do not necessarily reflect the opinions of any affiliated organizations or employers.

While efforts are made to ensure the accuracy of the information presented, no guarantee is given regarding its completeness, reliability, or suitability for any particular purpose. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Past performance is not indicative of future results. All investments carry risk, and the value of investments may go down as well as up. The author is not liable for any losses or damages arising from the use of this content.

By subscribing to and reading this newsletter, you acknowledge and agree to this disclaimer.